Rocket Lab’s Peter Beck Explains SPAC Strategy, Growth Targets, and Plans for Neutron

Peter Beck, Rocket Lab founder & CEO. Photo: Rocket Lab

New Zealand-based smallsat launcher Rocket Lab made headlines earlier this month when it announced plans to go public through a special purpose acquisition corporation (SPAC) and set a $4.1 billion valuation on the company. It also shared its plans to build a reusable, medium-lift vehicle called Neutron, with an 8-ton payload capacity.

The decision to go public brought CEO and Founder Peter Beck’s thesis for the company as an end-to-end space solution provider into full focus. Rocket Lab is a leading small satellite launch provider and has executed 18 launches since 2017. But, Beck wants to offer turnkey satellites and spacecraft components, on-orbit operations, and data services in addition to launch services.

Last year, Rocket Lab made $33 million in revenue from its launch business. If everything goes according to Beck’s plan, his Space Systems division, which made $2 million in revenue in 2020, will grow to $350 million in just four years — nearly the same size as the launch business, which he forecasts will bring in $399 million in 2025.

Via Satellite caught up with Beck, who explained the company’s decision to go public through the SPAC route, and outlines his vision for a vertically integrated, end-to-end space company.

VIA SATELLITE: Why are you taking the SPAC route to make Rocket Lab a public company?

Beck: We were already on a path to a traditional IPO. For a long time, we didn’t take any calls from the SPACs because we had our own trajectory. But a few approached us that were super high quality. For us, it was about who brings something to the table other than just a blank check. We saw it as an opportunity to accelerate our timeline. We probably shaved three to six months off our traditional listing.

Personally, I get a little bit worried when we see people who are going public as a financing round rather than a strategic direction. For us, it was an accelerant rather than an alternative source of funding.

VIA SATELLITE: Why did you choose Vector Acquisition as your SPAC partner?

Beck: We have a pretty decent M&A thesis, and the Vector has a team of 40 people in private equity and M&A. Having additional resources is super helpful. They did a lot of due diligence and they have a great reputation within the industry of being very discerning investors.

VIA SATELLITE: You have very optimistic plans for growth. Whether through a SPAC or an IPO, how will going public help Rocket Lab reach its targets for growth?

Beck: Rocket Lab has always been very private in its projects. If you look at our history, we don’t talk about anything until it’s either done or very close to done. Sometimes that’s controversial, because we put a satellite in orbit and go ‘Surprise, we now build satellites.’ It’s unusual for us to announce a program like Neutron as early as we did. But as a public company, it’s all coming out.

It’s giving us all the access to capital to go after programs like Neutron, but also other strategic directions within space applications and our space systems division. It also gives us the public currency to go and do other deals. We found in the past that not having public currency, it’s very difficult to make significant acquisitions and moves. We tried to do some deals last year as a private company, but when you’re competing with public companies, it’s almost impossible to do the kind of deals you want.

VIA SATELLITE: I spoke to a number of analysts recently about the recent group of space startup SPACs. While Rocket Lab is further along than some of the others, some of the analysts said that they’re skeptical on the valuations. What would you say to someone who might think that Rocket Lab’s valuation is inflated?

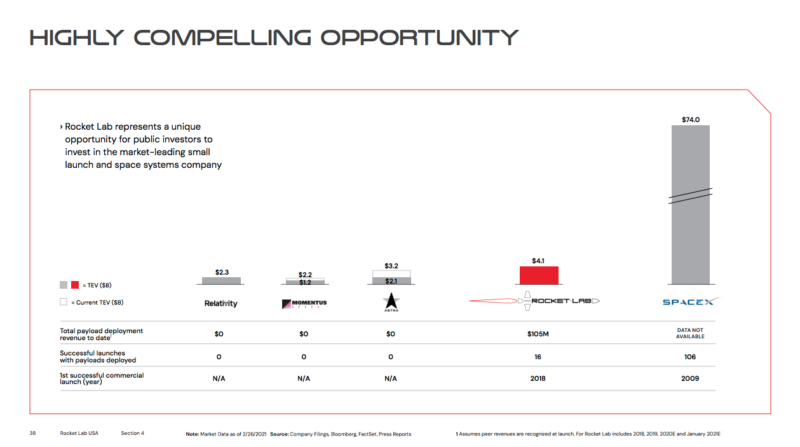

Beck: If you look to our left on the investor deck, there’s a bunch of companies that are very early, with no track record and no revenue. When you look to our right, the nearest comparison is SpaceX. You could make the argument that SpaceX is over inflated. But the nearest company to SpaceX right now is Rocket Lab. We think our valuation represents high value. If you look at where we’re at compared to the others, and if you look at where we’re going compared to SpaceX, it’s a fairly good deal.

Rocket Lab valuation benchmarking. Source: Rocket Lab investor presentation.

VIA SATELLITE: What are your thoughts about going through this phase of growth for Rocket Lab while under the scrutiny of being a publicly traded company?

Beck: You don’t become a public company without giving it some pretty deep thought. At the end of the day, you’re a public company and you need to deliver. We’ve always prided ourselves on doing what we say we’re going to do. We’ve put out to the public domain a clear plan of where we’re going. If you look back historically, a lot of things start to make sense, you can see the thesis running through what we’re doing. The big difference for us now is we’re talking about it. Those are our plans, and if public investors agree with them that will be wonderful. And if they don’t, that’s the life of a public company.

VIA SATELLITE: You are building Rocket Lab being an end-to-end space company with projects like the Photon satellite, and manufacturing components. What kind of customer experience are you hoping to create as an end-to-end service?

Beck: We’d love the customer to come to us and say ‘Solve this problem.’ [We want to] get away from an environment where every time you want to do something in space, it’s a new piece of infrastructure, a massive engineering undertaking. If we can put infrastructure in orbit that enables people to pull data or create services, then we shortcut a lot of pain in that chain.

The idea with Photon was — bring us your sensor or your payload, and we’ll put that on orbit for you. The next evolution for that is — tell us what problem you need solved. If you’re a telecommunication company, do you really want to own satellites and maintain satellites? If you’re a telecommunications company, you just want a big pipe in the sky.

I look at space through a simple lens. A rocket company is just a glorified freight company. Satellites in orbit are just infrastructure. It’s no different than pipes in the ground, it’s just pipes in the sky. I’m not sure that there’s going to be a bunch of launch companies and a bunch of satellite companies. When you couple both launch and spacecraft as one complete package, there’s so much advantage. It’s a very powerful model, rather than just focusing on building satellites or just being a freight company.

VIA SATELLITE: It sounds like you are saying eventually Rocket Lab will also be a remote sensing company that gives data to customers. Is Rocket Lab going to acquire a remote sensing company this year?

Beck: It’s certainly early stages. What I would say is that our focus for the last couple of years has been on building the infrastructure to be able to build infrastructure on orbit. Standing up the Space Systems division, and ensuring that we have a good supplier of spacecraft components. One of the challenges that we found when we stood up the spacecraft division was the fragility of the space supply chain. There are lots of amazing companies building tens or hundreds of things a year with really long lead times. At Rocket Lab, we’re highly vertically integrated. If we can’t get it in nine weeks, we’ll just go and build it ourselves.

What we’re trying to do with the Space Systems group is make sure that we have the full selection of components — everything we need to be able to build anything we need, for either ourselves or our customer.

VIA SATELLITE: With the Neutron rocket, I understand that constellations were a driver in its design. How did you approach the design of the rocket, and why did you change your mind and choose to build a bigger rocket?

Beck: We can’t build enough Electron [rockets]. We think that that kind of class is super important. It’s been useful for us to build relationships with customers to launch their pathfinder [missions]. The next conversation that comes after that is ‘Now I’ve got 200 satellites. What do we do?’

With respect to size, if we look forward to all the spacecraft that are planned, it falls slightly over the five-ton category in constellations per plane. We felt like bringing a right-size vehicle to the market was the sweet spot. Between the Electron and the Neutron we [cover] over 90% of everything needs to be launched. The things that we can’t launch are the school bus size Geostationary birds, which is a declining market.

Electron was all about manufacturability. Every decision we made around that vehicle was around how cost effective it would be to produce. With Neutron, that’s flipped on its head. Because it’s a reusable first stage platform, it’s no longer how manufacturable can we make this launch vehicle, but how reusable can we make this launch vehicle?

VIA SATELLITE: How does the development timeframe for Neutron compare to Electron?

Beck: With Electron, we raised our first capital in 2014, and we had a first test flight at the end of 2017. Included in that, we did bilateral treaties, built launch sites in other countries, built engine test facilities, and direct tracking stations. With Neutron, there’s a bunch of things that are just common parts of Electron. A third of the development program in avionics and software is done. And we’re launching out of Launch Pad 0A in Wallops and the vehicle is the right size for that pad. That’s a huge amount of pad infrastructure that we don’t need to build.

We’re pretty bullish on the timeline that we think we can achieve with the development of Neutron. We staggered our commercial rollout timeline of Neutron to reflect what we were able to achieve with Electron, with a little bit more padding.

VIA SATELITE: What is the status of your launch complex in Virginia?

Beck: [We have a] completely ready rocket sitting there, we’re just waiting for NASA to finish certification on Autonomous Flight Termination System [AFTS] software. The unit that will be coming out of this certification program will be able to be flown on anybody’s launch vehicle. We’re definitely taking one for the team on this. It’s certainly frustrating, but we understand that this is going to be great for the whole industry. I’m not going to second guess how long it takes.

VIA SATELLITE: You have a number of deals with NASA for interplanetary missions with the Photon. Are you looking to have similar deals with other space agencies around the world?

Beck: I would love that. Our view on interplanetary is that it’s super impactful for all of us here on Earth. With the way we currently do planetary science, if you’re a planetary scientist, you might get two missions in your professional career of record, because it’s one mission every decade. But that’s not how we do science on Earth. What we’re trying to bring with the Photon interplanetary platform is the ability to do a bunch of low-cost missions, one after the other.