Lower Barriers to Entry in the Satcom Market, and What that Means for the Incumbents

For a moment, let me take you back to the satellite telecommunications industry in 2008. Times were splendid. Satellite operators could count on sky-high Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) margins and stable cash flows due to a deep, wide moat around the industry. Satellite benefitted from very high barriers to entry, brought about by:

- Customers primarily being Direct-to-Home (DTH) platforms, and primarily signing very long-term (more than 10 year) contracts with satellite operators that they viewed as partners;

- Growth was coming from video, which itself adds an extra barrier to entry by virtue of it being very expensive to re-point millions of satellite dishes toward a different orbital slot;

- Satellites themselves were very expensive, and the total throughput on a given satellite tended to be relatively small. This meant that most operators wanted/needed multiple satellites, and that it was hard to enter the market with just one.

Indeed, 2008 was a good time to be a satellite operator. Fast forward to today, the industry is undergoing a period of rapid change, including an erosion of the high barriers to entry that satcom has seen historically.

This erosion is being caused by several factors, all of which are set to accelerate, with the next several years being a golden era for new entrants into the industry. While this will lead to lots of new capacity and a slew of market share fluctuations, the longer-term implications are less certain. What will bring about so many new entrants, and how might this play out?

First, why so many new entrants? Several factors are converging today that lower the barriers to entry. These factors include:

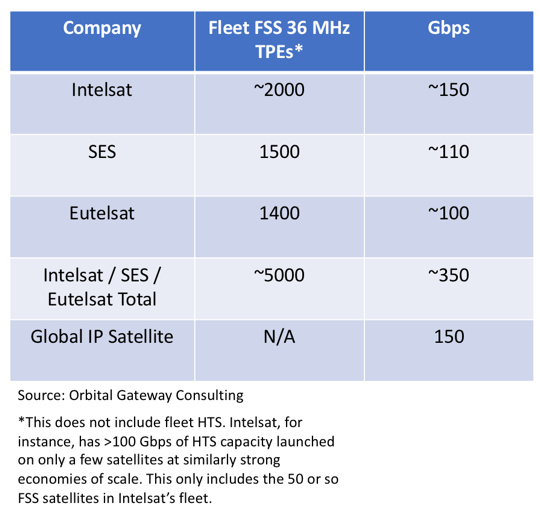

1) Massive increase in possible throughput on a satellite, without a massive increase in cost. To put this into perspective, at end of year 2017, Intelsat, SES, and Eutelsat’s combined wide beam capacity totaled approximately 5,000x 36MHz Transponder Equivalents (TPEs), or about 180 Gigahertz of capacity. If we translate this into Gbps assuming 2 bits per hertz, we therefore get around 350 Gbps.

For comparison, Global IP, a startup with currently zero satellites, will be launching a 150 Gbps High Throughput Satellite (HTS) over Africa in 2019-2020. For a number of reasons, the 150 Gbps on GiSat-1 are not a direct apples-to-apples comparison to Intelsat/SES/Eutelsat’s 350 Gbps of FSS capacity, but it nonetheless is worth emphasizing — these three operators spend hundreds of millions on fleet CAPEX per year, and these fleets represent over a decade of investment.

For example, it cost mid-high single digit billions of dollars to get to 5,000 TPEs at the capex efficiency of the 2000s. While Global IP’s satellite price is not known publicly, it would be in the low hundreds of millions of dollars. Clearly, there has been a step change in economics of scale that a satellite can expect to offer. It is important to note that Intelsat, SES, and Eutelsat have also invested heavily in HTS, and thus are benefitting from said economies of scale, but the point remains that it is getting easier to compete as a new entrant due to the ability to launch massive amounts of capacity for relatively cheap.

For example, it cost mid-high single digit billions of dollars to get to 5,000 TPEs at the capex efficiency of the 2000s. While Global IP’s satellite price is not known publicly, it would be in the low hundreds of millions of dollars. Clearly, there has been a step change in economics of scale that a satellite can expect to offer. It is important to note that Intelsat, SES, and Eutelsat have also invested heavily in HTS, and thus are benefitting from said economies of scale, but the point remains that it is getting easier to compete as a new entrant due to the ability to launch massive amounts of capacity for relatively cheap.

2) An increase in variety of funding sources. Historically, many satellites were financed by either the Export-Import Bank of the United States, or its European equivalent. While the past 24 months or so have seen the Ex-Im Bank take a step back from funding, where one door has closed, another has opened. New funding sources are entering the satellite industry from two main sources: China, and private investment.

The Chinese government, through its tarantula of state-owned companies, has been trying to take a bigger piece of the international satellite manufacturing and launch market for a while. This has involved easy financing for Chinese-built satellites, with the country having already sold several as part of its Belt and Road Initiative (satellites are infrastructure, after all).

The second funding source is the private sector. This is somewhat less direct, but private sector involvement has been benefiting satellite operators in different ways. The most obvious example is Elon Musk’s SpaceX and Jeff Bezos’ Blue Origin bringing down launch costs, but the involvement of these two men has generally made space sexy again, and funding more broadly is coming into the industry at a more rapid pace than before.

3) General decrease in costs. As noted above, launch costs have come down significantly with new competition. Concurrently, manufacturing costs have also been reduced. Moving forward, satellite operators are looking at ways to shorten in-orbit life so as to protect themselves from the uncertainty of a 15-year business plan in a rapidly changing industry, which may correspond to a decrease in satellite cost (though potentially higher cost on a “per year of life” basis).

These factors, among others, have led to a plethora of new entrants into the satellite industry, many of which are all or mostly HTS fleets.

Avanti was the pioneer for all-HTS new entrants. The company has struggled for a number of reasons, which can serve as a learning experience for contemporary new entrants. This includes Kacific, Global IP, and mu Space, all of whom plan to enter the market by 2020.

In addition to these players, several Chinese-manufactured satellites in the coming years will enable new entrants, or significantly increase the fleet size of existing small operators. Examples of this include the Royal Group of Cambodia, which bought a communications satellite from China Great Wall in early 2018. China also recently (since 2016) launched new satellites for Algeria, Belarus and, earlier this year, agreed to a two-satellite deal with Nigerian operator NigComSat. The latter involves China Great Wall taking an equity stake in NigComSat, and is believed to involve an HTS to be deployed over greater Sub-Saharan Africa.

Ultimately, what is the impact of all these new entrants, and what might the future hold in this regard? China is expected to continue to push satellites as broadband infrastructure along the Belt and Road Initiative countries, which is expected to bring in new entrants in a number of countries looking for universal service obligation satellites, or what we could call “pridesats” (national pride satellites). The most likely are seen as being Ethiopia and DRC, due to population size, historical ties to China, and past instances of collaboration with China on infrastructure. New “pridesats” may likewise suck up demand that would otherwise go to private operators.

Beyond this, private entrants elsewhere will also create new competition. While Avanti has struggled to this point, the operator has likely put negative pricing pressure on the Sub-Saharan African market for other operators. Should this be the case, operators may find an even more hostile pricing environment.

With that being said, new operators may also bring opportunities for collaboration. As new operators come into the market, they may seek commercial partnerships, they may seek to lease additional capacity from other operators to augment their network, and ultimately, they may help in getting the word out to end customers about the increasingly competitive nature of satellite for some potentially highly elastic verticals.

The brave new world of new entrants is not one for the faint-hearted, with new entrants expected to increase in an industry that is calling for consolidation. But with satellite developing more quickly than ever, new players may shake up the market and lead to the pie growing overall.

Blaine Curcio is the founder of Orbital Gateway Consulting (OGC), a boutique consultancy covering the commercial space and satellite telecommunications industries. Blaine spent over 5 years with industry consultancy NSR, where he covered fixed satellite services (FSS) markets from both a market research and financial perspective. Prior to his time at NSR, Blaine worked with SES’s Strategy and Market Intelligence team in The Hague. Blaine is based in Hong Kong, and speaks English and Mandarin.