Argentina’s Servicio Satelital Sees Domestic Market Growth, Interested in HTS

[Via Satellite 08-18-2016] Servicio Satelital, one of the largest VSAT service operators in Argentina, is optimistic that the country is now on the right path to restore growth to its economy, including the satellite sector. Stifled by inflation and political sparring with other nations, Argentina’s economy has underperformed in recent years. However Luis Eduardo Lema, director of operations at Servicio Satelital, told Via Satellite that following the late 2015 election of President Mauricio Macri, things appear to be on the upswing.

“We have seen very slow development of all the technology — not only satellite — here in Argentina for the past eight years. Eight months ago the government changed, and not only the government. The most important change is the vision of where the country must go. Today Argentina is in a better place in terms of the political and economic relationship with other countries like the United States, Great Britain, and Germany,” he said.

Servicio Satelital, formerly Gilat Argentina before Gilat divested in the company, is today 100 percent Argentine-owned. Lema said that since 2004 when the company received a new shareholder team, it has grown from having annual revenue of about $1 million to closing last year with $11 million. The company sells products such as Gilat’s SkyEdge 2 terminals and iDirect’s Evolution platform. Lema said the company sees lots of room to grow today.

“We have some goals that we have been trying to achieve for a few years now. One of them is to be the ‘carrier of carriers’ here, and we are very close to achieving it because we are giving services to Telefonica, Claro and [Empresa Argentina de Soluciones Satelitales] ARSAT in order to allow them to be focused on their main business, and we will be the satellite arm of each one. So our main goal for 2020 is to be the number one in market share of VSAT service providers — and we are really close — and to be the carrier of carriers,” he said.

Lema highlighted a number of new VSAT opportunities as well, such as an upcoming remote education project.

“We have a lot of schools with issues with internet connectivity. We are talking about 17,000 schools, so probably in the next year we will see a chance to grow in terms of remote sites from schools,” he said.

Another project, under the leadership of ARSAT, is to expand the nation’s Fiber Optic Federal Network with thousands of miles of new fiber. Lema said Argentina’s new president is pushing to extend fiber to small towns, which could also stimulate demand for satellite.

“In the future, [I expect] we will work jointly with ARSAT in order to fund the network as a complement to fiber optics. We are talking about two projects with maybe a thousand VSATs in the next four years,” he explained.

Oil and gas, another demanding market in Argentina, currently offers little new satellite opportunity because of market conditions. Lema described this market as frozen, but expressed confidence that operators will need new value-added services in the future. Another potential catalyst is newfound foreign investment. Lema said other countries are very interested in putting money in Argentina, where, before, pricey and highly publicized disputes dissuaded such moves.

“The very important thing is that we are ready to start a new age in terms of receiving capital investments, and the rest of the world is very interested to invest money in Argentina because we are a country with high potential now, which was not so for the last eight years,” he said. “For the past eight years we were just trying to survive.”

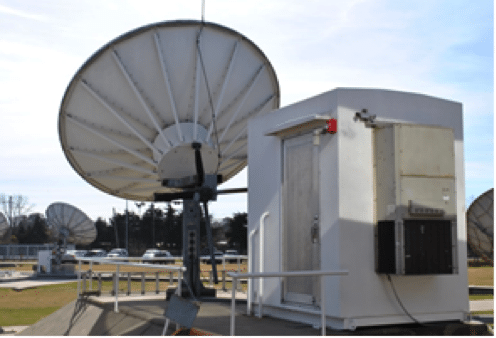

Lema said Servicio Satelital is planning new infrastructure investments such as a new Radio Frequency (RF) system and a 7.5-meter dish in order to add space segment on a different satellite. For capacity, he said the company recently shifted from SES’ AMC 6 satellite, launched in 2000, to the new ARSAT 1, which launched in 2014. Lema said Servicio Satelital is considering what additional capacity it will use now that ARSAT 2 is in orbit, but lamented that the price of capacity is high. He said the company is trying to get ARSAT to offer lower prices so they can purchase more space segment.

Servicio Satelital is also interested in using High Throughput Satellite (HTS) capacity, however this is not yet available in the country. Lema said the Argentine government has protectionist policies that favor ARSAT in place, blocking other potential suppliers of HTS capacity.

“Really it all depends on what will be the conception from the new government in terms of free skies or not, because the last administration made protective rules for ARSAT to avoid competing with other satellites here. So if you see the landing rights of HTS satellites, we do not have any HTS satellites allowed to legally bring services here in Argentina,” he said.

Lema added that ARSAT 3, which will support Ka-band, could be the first HTS allowed to bring services to Argentina, though it is not scheduled to launch until 2019. Excluding HTS, foreign satellite operators — notably Intelsat, SES, Telesat and Hispasat — are able to provide traditional capacity in the country. Lema said Servicio Satelital is awaiting future policy decisions that will influence its capacity procurement.

“The government has to make a decision if it will let the Amazonas or other HTS satellites to enter Argentina. We are analyzing because we are ready to do some joining with other big companies in order to bring services here over an HTS satellite,” he said. “But today it is not possible.”