Satellite Builders Innovate as Telecom Industry Rockets Ahead

Spacecraft manufacturers are jockeying for position in a fast-changing market driven increasingly by customer interest in on-orbit flexibility, reduced costs and faster production times.

Spacecraft manufacturers are jockeying for position in a fast-changing market driven increasingly by customer interest in on-orbit flexibility, reduced costs and faster production times, according to top executives of several communications satellite suppliers. Satellite operators are eager to gain every competitive edge and are pushing manufacturers to develop satellites that deliver better performance and new capabilities — even if that means moving away from some of the proven “heritage” systems that have long defined the satellite market but are becoming dated.

“The competition is making the market extremely lively and intense,” says Eric Béranger, head of Airbus’s satellite manufacturing division, formerly known as Astrium. “We are dealing with top technologies. As soon as you touch space, you are really at the edge of what mankind is able to produce.”

Industry officials agree that the market for new satellites is healthy and heading into a period of stability as traditional satellite operators look to bolster their fleets to remain competitive and other companies contemplate purchasing satellites. Manufacturers say they expect between 20 and 25 orders per year for commercial communications satellites during the next few years. Many of the new orders are likely to be replacements for aging spacecraft already in orbit, says John Celli, president of Space Systems/Loral (SSL).

The satellite market “is driven by the increasing demand for digital content,” says Celli. “The satellite is basically a means of transporting digital content from one place to another, from one continent to another, and it doesn’t matter whether it’s video or audio or data.”

Indeed, buyers are increasingly looking for high-throughput satellites that can help them handle the large amounts of data satellite users want to move, says Jim Simpson, president of Boeing Satellite Systems International. “Being connected 24/7 seems to be more and more the theme.”

The industry is being encouraged to innovate by an investment community that is more willing to take risks than it was in the past, says Jeremy Rose, principal of Comsys LLP, a London-based satellite consulting firm.

“There seems to be a situation at the moment where people are much more keen to fund projects that are perhaps pushing the envelope as far as the technical issues are concerned,” says Rose. “I think we’re in a cycle now where people are saying, ‘let’s push the boat out and take a chance.’”

Still, manufacturers continue to face the challenge of convincing customers to try new technologies on their satellites, according to Celli, whose company produces satellites based on a design known as the 1300. “We all need to recognize that our customers are quite conservative. It’s very difficult to propose a new technology that doesn’t have in-orbit heritage,” he says. “They have reason to be conservative, because they are deploying systems that cost a large amount of money.”

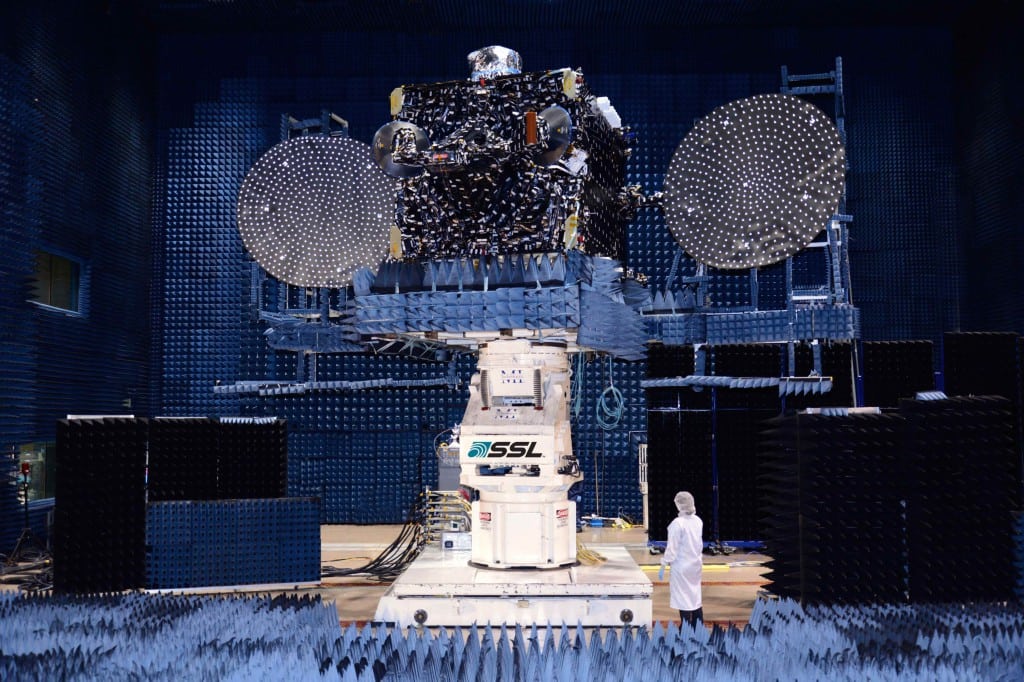

The Optus 10 satellite, designed and built by SSL based on its 1300 platform, at SSL’s Compact Antenna Test Range in Palo Alto, Calif.

Photo: SSL

One way manufacturers try to overcome reluctance on the part of buyers to invest in new technology is to work closely with their customers on the design, construction and testing of their spacecraft, Celli says. Satellite operators have a long history of working alongside the teams that build their spacecraft, and those relationships are proving invaluable as manufacturers strive to provide more capabilities to their customers, he says.

“We talk to our customers and ask them to be involved in the design and qualification process, and we invite them to critical design reviews,” says Celli. “Most of our customers today have an incredible amount of technical expertise … we’re not shy, and we ask them what their opinion is. That way, at the end of the qualification process, when we are ready to deploy new technology and new products, it’s a lot easier. It’s a long process, and it has to be done in little steps.”

Among the features satellite customers want on their spacecraft are highly flexible payloads that can be reconfigured after launch, industry officials say.

“We’ve now gotten to the point where it’s pretty much an industry norm that satellites are designed for 15 years of on-orbit life, and in many cases will actually produce more than that,” says Mike Hamel, president of commercial ventures at Lockheed Martin Space Systems. “It’s really important to adapt the service you can offer over the life of a particular satellite.”

Lockheed Martin is moving beyond the conventional definition of a satellite as essentially a radio-wave reflector in the sky as it strives to develop payloads that can more readily adapt to different business cases after a satellite is launched, Hamel says. The company is using technology such as software-driven processing systems that enable a spacecraft to be reconfigured from the ground, helping to maintain its usefulness as market conditions change during the satellite’s lifetime. These improvements will be “a real game changer” for commercial operators in the years ahead, says Hamel.

The aerospace company is also working to reduce production costs and deliver satellites more quickly, he adds.

“There was a real commitment a couple of years ago to do a rather comprehensive technology update of the A2100 platform,” with a goal of reducing manufacturing costs by 35 percent and shortening construction times by a quarter, Hamel says, referring to the company’s satellite platform. “We’ve got a very comprehensive internal R&D program for that technology update.”

Lockheed Martin’s competitors are also looking for ways to streamline their processes. “The ability to provide systems very quickly and inexpensively is now the dominant requirement,” says Celli.

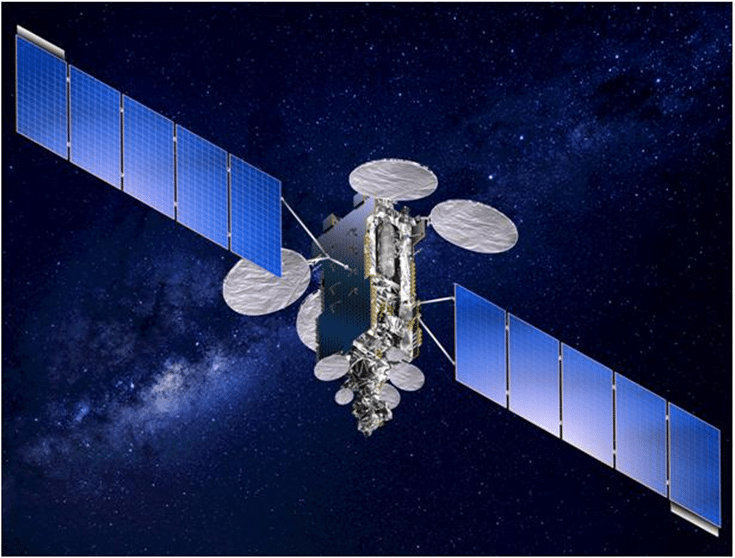

Lockheed Martin-built Jabiru 1 satellite for Newsat is being built on Lockheed Martin’s A2100 platform. This will be Australia’s first High Throughput Satellite.

Photo: Lockheed Martin

Lockheed Martin’s efforts to strengthen its competitive position comes as the firm shifts its attention back to the commercial satellite market after more than a decade of concentrating heavily on government customers. “A couple of years ago, as it became obvious that we were transitioning from large development efforts to more production satellites in our government market, and likewise the prospects that the government markets were likely to be flat and perhaps even declining, we really shifted our attention to reestablish a strong position in the commercial and international market,” Hamel says.

Celli says buyers of smaller satellites are particularly interested in the ability to make adjustments after launch. “On the smaller-scale satellites, what’s really important to the customer is flexibility — the ability to change the function of the satellite while it’s in orbit,” he says. Just as important as improvements aboard satellites that are increasing their flexibility and capabilities are the advances that are taking place on the ground.

“We tend to look at new technology as only important for the satellite, but the satellite is just a big switch in the sky, and it works with a lot of ground equipment,” he says. “It is the coordination of the technology on the satellites and on the ground that is important to the customer … there is continuous improvement in the ground technology as well.”

Celli says putting more flexible technology onboard satellites is expensive, in part because deploying technology without a significant track record of successful performance in space makes it necessary to do more testing before launch. He predicts, however, that these costs will decline over time. “The complexity today still demands additional costs for integration and testing … but that will come down eventually,” he says. “There will still be a difference between the real flexible satellites and the non-flexible [spacecraft], but the difference will be shrinking.”

Buyers are also showing growing interest in satellites equipped with electric propulsion technology, which manufacturers offer as an alternative to the chemically driven equipment traditionally used to move spacecraft from the point where they are dropped off by a launcher to their final slots in geostationary orbit, says Simpson. Many satellites already use electrically based systems for station-keeping.

Satellites equipped with electric propulsion systems are lighter than comparable spacecraft with chemical propellant systems because they do not need to carry tanks and liquid fuel to use for orbit-raising maneuvers. This allows operators to either save on launch costs or deploy more transponder capacity than would be possible on a satellite of the same weight equipped with a chemical propulsion system.

“For a given launch vehicle you can put a lot more payload on an all-electric [satellite] than you would on a liquid version because you don’t have to carry with you all the way up the mass of the liquid propellant,” says Celli. “That’s a big advantage.”

Boeing is on track to complete construction on four all-electric propulsion satellites based on its 702SP platform for operators ABS and Eutelsat by early 2015, and expects to announce additional orders later this year. In another sign of customer interest in satellites with electric propulsion systems, Thales Alenia Space announced in May that it would work with Snecma to provide the technology on future satellites based on Thales’ Spacebus platform. But electric propulsion comes with a significant drawback: It can take as long as six months to move a satellite from geotransfer orbit to its final orbital slot, versus just a few days with conventional chemical propellant.

“You have a tradeoff of having a lower cost of capacity in orbit on one side and on the other side being able to operate and generate revenues sooner,” says Béranger, and this poses a challenge to buyers. “When you have put the money on the table, when you have invested to procure the satellite launch services, generally you are very much in a hurry to generate revenues in order to repay the investment that you have made.”

The ABS 3A is one of the first all-electric satellite Boeing builds using its 702SP platform. Photo: Boeing

Nevertheless, despite the time it takes to move satellites using electric technology instead of chemical propellant, Béranger says a fifth of the requests for proposal Airbus receives specify the use of electric propulsion for orbit-raising, because operators recognize the considerable benefits of being able to put more transponder capacity on a satellite without pushing up its weight.

Celli has a similar perspective. He says that although there is little manufacturers can do to reduce the amount of time an electrically driven satellite will take to get to orbit, there are ways to make the economics work.

“It’s always possible to reduce the time to launch by a little bit, but it will certainly not compensate for the … five-plus months that it will take to go to orbit” using electric propulsion, says Celli. “But if you plan in advance you can certainly cover the [extra time]. If you don’t, then you’re just losing five or six months of value.”

Hamel says Lockheed is working on technology that would allow electrically driven satellites to travel to their final orbits as much as twice as fast as they can with the systems available today. “We think that will be a real differentiator for customers that are really looking for maximum mass efficiency,” he says.

Interest in the weight savings offered by electric propulsion technology is being heightened by the success SpaceX has had with its Falcon 9 rocket, which can carry two satellites at once as long as they are not too heavy, adds Hamel. SpaceX has made a name for itself in the commercial satellite industry by charging lower prices than competing launch providers.

If launch prices go too low, however, they could actually make customers less interested in electric propulsion systems to boost satellites to geostationary orbit, because as deployment costs decline, enduring the long wait until a satellite is ready to go into service becomes less worthwhile for a satellite operator, says Stéphane Gounari, senior analyst with Northern Sky Research based in Dublin.

“Electric propulsion is now seen as one additional tool for the manufacturers to propose … the most efficient solution, but it’s not expected to become dominant,” Gounari says. He expects customers to opt more often for satellites that use electric systems to maintain a satellite’s position in orbit but depend on traditional liquid propellant for orbit transfers.

Indeed, Orbital Sciences Corp. announced in March that its new GEOStar 3 satellite bus — an upgraded version of the satellite manufacturer’s existing GEOStar 2 design — will be offered with a hybrid system that uses traditional chemical propulsion to travel to geostationary orbit and electric propulsion only to fly the satellite during its operational lifetime.

In addition to generating interest in electric propulsion systems, lower launch costs could drive demand for satellites in general, says Celli. “You certainly have to give credit to SpaceX for changing the paradigm when it comes to access to space. They just started, and they have a long way to go, but I think they certainly shook up the launch vehicle part of our industry, and you’ll very likely see changes to make more frequent and less expensive.” VS