Latest News

Eutelsat’s full year results contained two surprises: the first was lower than expected guidance for one-year and three-year growths. Having had two profit warnings in the last 15 months, management seems to be taking a more cautious approach to the targets it sets for the market. The other surprise was the announcement that Eutelsat is acquiring Satmex for an enterprise value of $1,142 million. Excluding the value of tax assets – i.e. before netting this from the purchase price – this represents a multiple of 10.6 times adjusted LTM EBITDA, while after the tax asset of c$100 million is taken into account, the company estimates this to be c9.7 times on the same profit basis.

This multiple obviously looks reasonably high, certainly at a premium to Eutelsat, and was thus viewed as potentially dilutive to shareholder value. However, the growth prospects for Satmex should be materially higher than for Eutelsat as a whole, in our view. Firstly, demand in the Latin American region, which is the focus of Satmex’ business, is forecast to be materially higher than that of EMEA, which is the main area of Eutelsat’s existing operations. Secondly, Satmex capacity is set to more than double over the next few years, but the incremental capital cost to Eutelsat will be quite limited, given that the satellites that are due to be launched will be pretty low cost relative to Eutelsat’s “normal” satellites, and also largely paid for already.

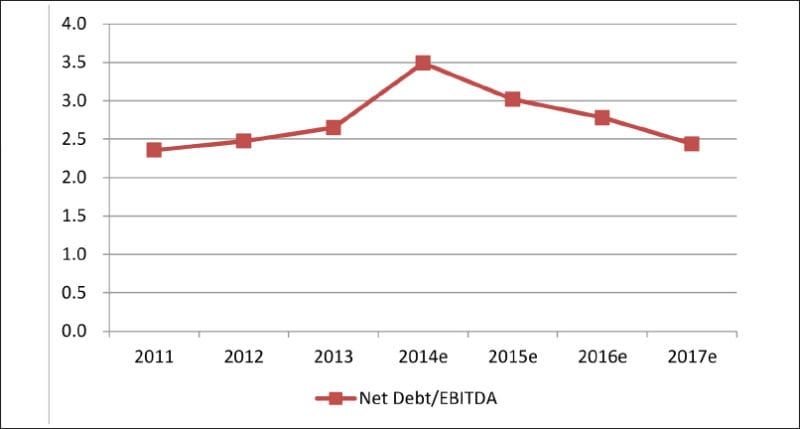

Figure 1: We expect strong infrastructure revenue growth at Satmex on the back of increased capacity. Source: Company data, Berenberg.

As shown in the chart, we forecast that Satmex satellite service revenues will grow from $112 million in 2012 to more than $200 million by 2016, driven by an uptake on the recently launched Satmex 8 as well as on the satellites yet to launch at the end of 2014 and in 2015. Infrastructure margins are actually higher than those of Eutelsat but, on a total group basis, there is dilution from a Hispanic programming distribution business, which in 2012 had an EBITDA margin of 42 percent, which we assume will remain constant.

We note that currently Satmex revenues are only 9 percent derived from video, as opposed to 68 percent of Eutelsat’s pre-Satmex revenues. The deal will thus dilute Eutelsat’s exposure to video, which generally has longer duration contracts as well as higher revenue per transponder. Management believes that there are good opportunities to grow video revenues, although we should point out that this market is also being targeted by SES, which recently launched SES 6 into the Latin American market with anchor tenant Oi. We also believe that SES plans another satellite for this market, essentially endorsing Eutelsat’s views that the market offers potential, while at the same time possibly increasing competition.

From a financial perspective, besides the shorter contract duration and associated lower backlog as a multiple of revenues, capacity fill rates are likely to ramp more slowly than they would had the capacity been more oriented toward video, although we note that Satmex 8 has already sold well, with c15 transponders sold within the first few months after launch. Equally, the revenue per transponder is lower, by c20 percent on our estimates, than that achieved on average by Eutelsat in non 13 degrees and 28 degrees positions. This reflects the higher component of data, which generally commands a lower rate, as well as the fact that capacity is being sold into an emerging market, of course.

Taking the deal overall, we do not believe that valuation is unreasonable. Indeed, if we discount the cash flows generated over the next 10 years on this business, including the cost of replacing Satmex 6 and Satmex 8 at the appropriate time, and set a terminal value that is calculated using normalized capex for the four satellites, we derive a fair value of $1.2 billion assuming a weighted average cost of capital of 10 percent. This compares to the cost of capital of 8 percent that we use for Eutelsat (and SES). In other words, we believe that the return on this deal, over time, will exceed ETL’s cost of capital.

This being said, there are issues with the deal, namely that

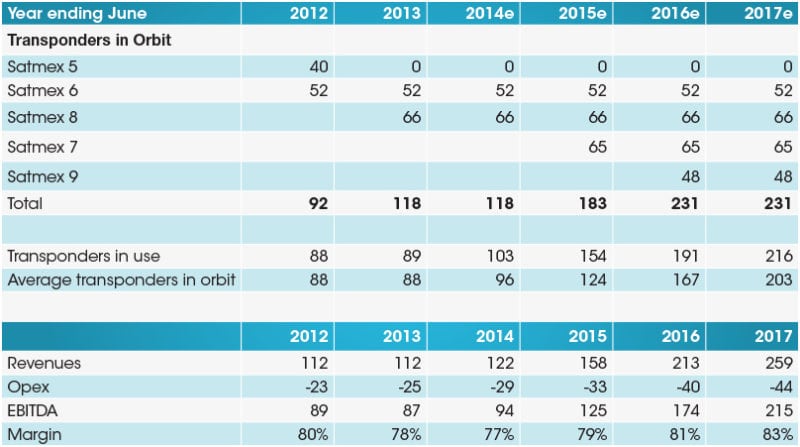

a) Leverage is set to exceed Eutelsat’s target 3.3x ceiling, albeit temporarily. As shown in the chart, we see net debt/EBITDA dropping back below this level in 2015. Both Moody’s and S&P have put Eutelsat’s credit ratings under review, with potential demotion to the lowest investment grade level. Eutelsat management, it should be pointed out, has reiterated its intention to bring leverage back to target levels as soon as possible, and had discussions with the ratings agencies prior to announcing the transaction.

b) Given the leverage, it is now highly unlikely that Eutelsat would be able to buyback the remaining Abertis stake (5.6 percent), which some had hoped it might do. This means that there is some risk of overhang from the Abertis stake, and no chance of Eutelsat enhancing EPS through buybacks.

c) At the same time, while Eutelsat has historically matched SES’ dividend increase (although it did not have the same policy of “at least 10 percent per annum”), it is unlikely that it will be as generous until the leverage drops to lower levels. Indeed the 2013 dividend was a little light versus expectations.

Overall, however, we believe that this deal should be taken reasonably positively. It will accelerate the group’s growth rate, which has been slowing as it faces the twin issues of saturation at some of its most valuable orbital positions, and it extends Eutelsat’s Latin American footprint, which, before this transaction, would have been based entirely on the recently ordered Eutelsat 65WA, which has a coverage that is largely complementary to that of Satmex. As noted above, we do not think valuation is unreasonable given the growth potential inherent in this business, indeed we believe that the returns should exceed Eutelsat’s cost of capital. The main downside is the leverage, which as noted above, will limit the company’s flexibility in terms of buybacks and dividends.

Get the latest Via Satellite news!

Subscribe Now