Northrop Grumman Space Systems Boosts Sales in Q2, But Logs $36M NASA Charge

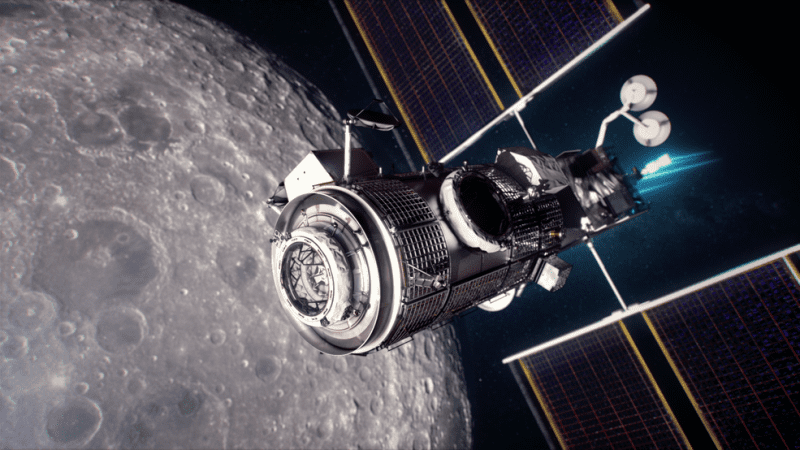

A rendering of the Habitation and Logistics Outpost (HALO), one of the elements of Gateway. Photo: NASA

Northrop Grumman’s Space Systems segment posted double-digit growth in the second quarter of 2023, leading the company in sales growth, while also taking a $36 million charge from the HALO lunar contract with NASA. Space Systems reported $3.5 billion in revenue in the second quarter of 2023, up 17% from the same time last year.

Company-wide Northrop Grumman posted $9.6 billion in sales in Q2, up 9% from the same period last year, according to financial results released July 27. All segments increased sales in the second quarter.

At $3.5 billion in revenue, Space was Northrop’s largest segment for the quarter, surpassing Aeronautics Systems’ $2.6 billion in revenue.

Within the Space segment, Northrop Grumman reported growth in both Launch & Strategic Missiles and Space. Sales in the Space business area increased with higher volume on restricted programs, the NextGeneration Overhead Persistent Infrared Polar (NextGen Polar) program and the Space Development Agency (SDA) Tranche 1 Tracking Layer program. However, the segment had lower volume for Commercial Resupply Services (CRS) missions during the quarter.

Space logged a $36 million charge on the fixed price HALO lunar contract for NASA. HALO stands for the Habitation and Logistics Outpost, and it will be living quarters for astronauts working on the Gateway, the planned in-orbit moon outpost. NASA awarded Northrop a firm, fixed-price contract in July 2021 valued at $935 million. Northrop said there was an unfavorable estimate at completion (EAC) adjustment on the program from increased costs on the evolving Lunar Gateway architecture and mission requirements, combined with macroeconomic challenges.

Northrop Grumman CEO Kathy Warden addressed the charge on a Thursday call with investors: “We’re being even more disciplined moving forward, ensuring that we work with the government to have the appropriate use of fixed-price contracts. We think that is best applied for commercial items or production programs with stable requirements and mature design,” Warden said. “As it is turning out on the HALO program, the requirements are not as stable as we or the government anticipated, and we’re working with them to address that change management as we go forward.”

Space’s operating income declined 9% compared to the same time last year, to $283 million. Space had the largest decline in operating income of any of the four segments.

For the first half of 2023, Space’s operating margin rate is 8.7%, the lowest in the company.

Warden said overall the Space business is performing well and said she is pleased with the roughly 9% margin rate for a segment that has a number of programs in the early phases of development, versus production. Northrop is working to grow Space’s margin to 10% and it has the potential to go higher, she said.

“When you look at 9% for a business that has absorbed that type of growth, and has been able to continue to manage through the disruption of the macroeconomic environment, we feel like we’re in a good place,” Warden said.

“Certainly there is more risk in development programs, and that’s why we generally have lower margin rates coming out of development. But as Space has transitioned programs to later stage development and production, their performance is as solid as the rest of the business and we expect that to continue,” she added.

Warden said about half of the Space Systems growth comes from two missile programs — Ground Based Strategic Deterrent (GBSD) and Next Generation Interceptor (NGI), and the other half from a broad set of programs, particularly in national security space. The national security portfolio accounts for about 80% of Space business, Warden said.

Northrop Grumman adjusted Space guidance as well, now expecting revenue in the high range of $13 million compared to mid-$13 million. However, it narrowed the operating margin expected from mid-9% to roughly 9%.

Northrop Grumman’s Space segment has seen rapid growth in its Space Systems segment in the past few years after reorganizing in January 2020. In 2022, Space Systems reported $12.3 billion in sales, up 16% over 2021 sales.