Yahsat’s Mobility Solutions Business Sees Double-Digit Growth, Thuraya-4 on Track for 2024 Launch

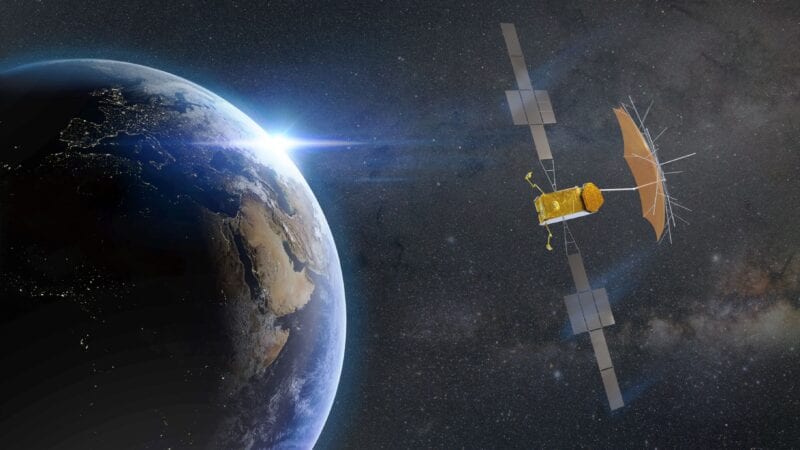

Airbus is building Thuraya 4-NGS for Yahsat, based on the all-electric Airbus Eurostar Neo Platform. Photo: Airbus

The United Arab Emirates’ flagship operator Al Yah Satellite Communications Company (Yahsat) is enjoying its strongest fiscal year in the last five years, with both its 2023 nine-month revenue and normalized EBITDA increasing 3% year-over-year, driven by 22% growth in its Thuraya-branded L-band mobility solutions business in the first nine months compared to the same period last year. Thuraya said that higher equipment sales and service revenues created “historic” net gains for the company.

In its third quarter 2023 results issued Tuesday, Yahsat reported an 8% year-over-year (YoY) increase in overall revenue. Yahsat’s largest business segment, Infrastructure, which provides communications capacity to the UAE government via an index-linked long-term contract, grew its YoY revenues by 1%. Managed Solutions, the group’s second largest segment, reported slightly lower revenues due to what the company described as an “exceptionally strong comparative period”

Yahsat Group CEO Ali Al Hashemi said the operator’s financial position has never been stronger as it awaits the delivery and launch of the Thuraya-4 NGS satellite, built by Airbus.

“[Thuraya-4] remains on track for launch in 2024 and entry into service in H1 2025, with new advanced capabilities that will allow us to offer additional applications to our customers,” said Al Hashemi. “Our largest ever contract award during the quarter – an 18.7 billion UAE Dirham [$5.1 billion] satellite capacity and managed services mandate from the UAE government that includes the procurement of two new satellites, Al Yah 4 and Al Yah 5, has propelled our contracted future revenues to an all-time high and will support our core government business going forward whilst securing significant predictable cashflows all the way out to 2043.”

The operator ends Q3 with a positive net finance income of 36 million Dirham ($10 million) and is on track to grow fiscal year 2023 dividends by at least 2%. Yahsat maintained its guidance for fiscal year 2023 revenue, EBITDA, and cash CapEx and increased its guidance for discretionary free cash flow to a range of 514-588 million Dirham ($140 million to 160 million).