Latest News

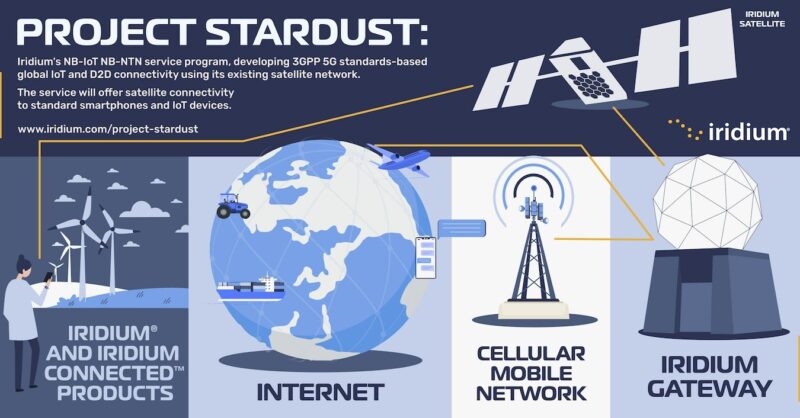

Graphic of Iridium’s Project Stardust, a standards-based direct-to-device service. Graphic: Iridium

Iridium is taking a new approach to the direct-to-device (D2D) market after its deal with Qualcomm ended, announcing “Project Stardust” on Wednesday — an upcoming 3GPP compliant D2D service for smartphones and IoT devices that operates on Iridium’s existing network.

The project is in its early stages; Iridium expects testing to begin in 2025, with service beginning in 2026. Iridium announced the project as an opportunity for smartphone companies, OEMs, chipmakers, mobile network operators (MNO) and IoT developers to collaborate.

Stardust is different from Iridium’s work with Qualcomm because it operates on 3GPP standards. The Qualcomm partnership was an exclusive Qualcomm chip that was compatible with Iridium’s proprietary waveform. While it was initially pitched as the Android answer to Apple’s emergency messaging via satellite, adoption didn’t take off. Analysts said the lack of technology standards was a contributing factor.

In a call with media on Wednesday, CEO Matt Desch said Iridium saw the Qualcomm chipset as a way for Android manufacturers to quickly deploy satellite-to-cell connectivity to compete with Apple. However, manufacturers did not want to get locked into a single chip supplier.

This standards-based initiative is non-exclusive, and will offer the same type of service, along with “more long-term flexibility and assuredness that no matter what happens, [manufacturers] can move around easily,” he said.

He said Iridium is working with the standards bodies and chip suppliers to embed Iridium’s frequencies into standard chipsets. It will not be exclusive to Android, and could be adopted by any chip manufacturer — whether it be for Apple’s iOS, narrowband IoT devices, laptops, etc.

“Any OEM or smartphone, or watch, or laptop provider who wants to offer a service to connect through our network can deploy this into their devices,” he said. “If it’s provisioned to go on our network by whoever turns it on, it will roam onto our network.”

The initial offering will support 5G messaging and SOS capabilities — not broadband levels of service like some other D2D players are targeting. The service could potentially be accessed via an app or embedded within the operating system, Desch said, but those details are being worked out.

Desch described the engineering work for Iridium as allocating channels so Iridium’s satellites can offer 180 kilohertz standardized data channels using its existing spectrum over the existing network. There are ground-based updates as well. He placed the total cost of Iridium’s investment to bring Project Stardust to market within the “tens of millions.”

“We plan to provide this service from our existing fully deployed constellation. This is a testament to the power and flexibility of the Iridium Next constellation and our ability to put new software in it to do new functions,” Desch said. “It’s not a trivial effort, but it’s a lot less than having to build and launch new satellites, like others have to do to try to address this opportunity.”

Desch held the call from the CES trade show, where he said Iridium is meeting with a number of chip manufacturers, OEMs, MNOs, and IoT developers about the project. Iridium is receiving “a lot of support” and enthusiasm, he said.

“It’s fair to argue that we may be the most sure thing — with an already fully deployed network, globally approved coordinated spectrum, and all the business processes and partner development already in place,” he said. “Others are more likely to be a regional service, relying on other spectrum. I think this will be complementary to those as well.”

Desch has been skeptical about the overall size of the satellite direct-to-device market. Iridium never gave projections about revenue from the Qualcomm deal and never included it in guidance. However, in September, he did name is as a market opportunity that could help Iridium reach $1 billion in annual service revenue by 2030. On Wednesday, Desch called Project Stardust an “incremental opportunity on top of our already growing and thriving business.”

Get the latest Via Satellite news!

Subscribe Now