SatixFy to Go Public in SPAC Deal at $813M Valuation

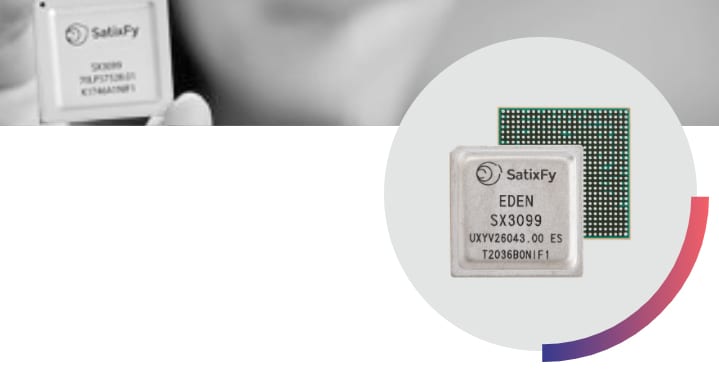

SatixFy’s 3099 processor chip, as presented on SatixFy’s website.

Satellite ground technology company SatixFy is in the process of going public through a special purpose acquisition company (SPAC) deal with Endurance Acquisition Corp. The deal, announced Tuesday, will make SatixFy a publicly traded company with an $813 million valuation.

SatixFy, headquartered in Israel, is a vertically integrated fabless semiconductor chip company that offers products based on its own chipsets. The company produces chips, software, modem and digital beamforming antenna products in-house. It has agreements in place with Telesat, OneWeb, ST Engineering iDirect, and Airbus. SatixFy is designing and building a multi-beam antenna for in-flight connectivity applications for OneWeb’s constellation, and supplying baseband modem equipment for Telesat’s Lightspeed constellation.

According to its investor presentation, SatixFy reported $22 million in revenue in 2021, and expects to earn $40 million in revenue this year. The company projects it will reach $374 million in revenue by 2026. SatixFy said it had invested $180 million in R&D at the end of 2021.

When the SPAC is completed, SatixFy projects it will receive approximately $201 million from Endurance’s trust account, assuming no redemptions by Endurance’s public stockholders, as well as $29 million in gross proceeds from PIPE investors. In addition, SatixFy has received a committed equity facility of $75 million from CF Principal Investments LLC, an affiliate of Cantor Fitzgerald. SatixFy also recently closed on a financial commitment of $55 million from Francisco Partners.

SatixFy Co-Founder and CEO Yoel Gat, who previously founded Gilat Satellite Networks, said going public will help SatixFy capture a $20 billion 2029 market opportunity across ground terminals and payloads for Low-Earth Orbit (LEO) broadband satellites, as well as commercial and business aircraft.

“We have high visibility to at least $40 million in 2022 revenue from contracts with existing customers. With the addition of the new available funds from this transaction the company is targeting strong business expansion, which will result in strong revenue growth with profitability expected in 2023 and beyond. Longer term we are well positioned to capitalize on other potentially large incremental opportunities,” Gat said.