Aerojet Rocketdyne Shareholders Approve Deal With Lockheed Martin

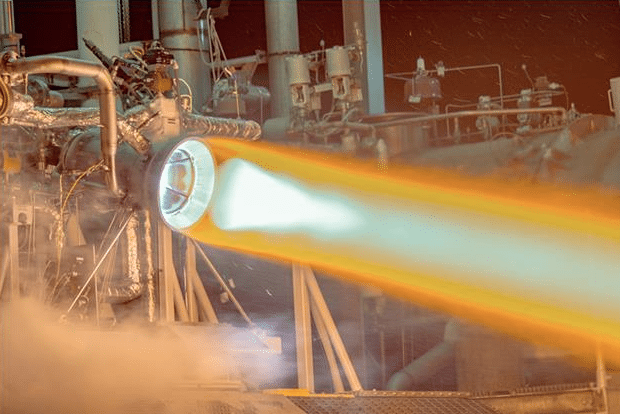

Aerojet Rocketdyne’s hot-fire test of an additively manufactured thrust chamber assembly at its West Palm Beach, Florida facility in 2017. Photo: Aerojet Rocketdyne.

Aerojet Rocketdyne said Tuesday evening that its stockholders have approved the $4.4 billion sale of the company to Lockheed Martin, clearing a hurdle on the deal that is still expected to close in the second half of 2021. Lockheed Martin announced the deal in December, and said it will lead to better integrated end products and improved manufacturing,

The transaction still needs federal antitrust approval.

The pending deal is getting scrutinized by the federal government. In February, Lockheed Martin said the Federal Trade Commission had requested additional information about the acquisition as part of the regulatory review.

Aerojet Rocketdyne supplies tactical rocket motors and other propulsion systems for missiles and large rockets, competing with Northrop Grumman, which entered these markets through its acquisition of the former Orbital ATK.

Gregory Hayes, CEO of Raytheon Technologies Corp., also said last month that his company has concerns about the pending acquisition. He highlighted that Aerojet Rocketdyne is an important supplier of solid rocket motors to his company.

The U.S. government requires Northrop Grumman to continue supplying rocket and missile propulsion systems to other companies in the aerospace and defense industry. Lockheed Martin says it will do the same with Aerojet Rocketdyne.

This article was originally published by our sister publication Defense Daily.