Latest News

Via Satellite archive illustration

An increasingly volatile geopolitical landscape is forcing nations to rethink space — fast. Alliances once assumed to be stable now look precarious. Supply chains once described as “global” now reveal their fragility. Access to foreign infrastructure can no longer be taken for granted. Governments everywhere are waking up to a single, urgent reality: sovereign control of space-based capabilities is no longer optional; it is strategic survival.

The debate is over. Space is critical infrastructure. The real battle now is determining: Which constellations will be designated sovereign, who will build and operate them, and how aerospace and defense players will stake their ground.

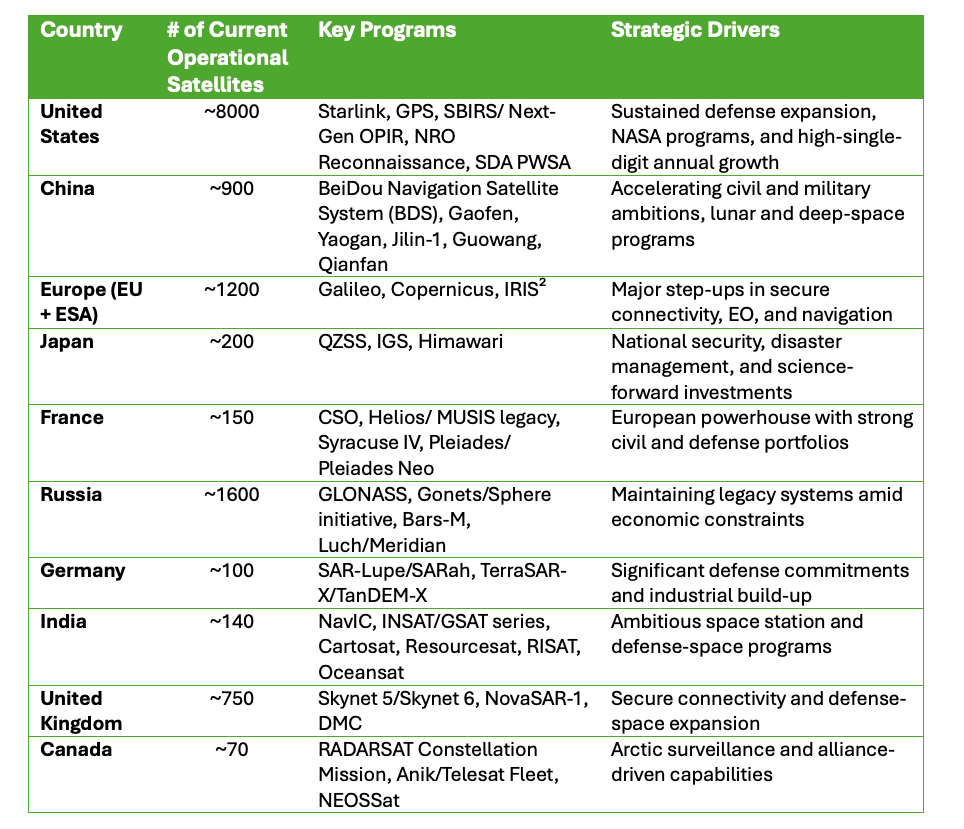

Space sovereignty has moved far beyond prestige projects or symbolic missions. Nations are designing full-spectrum portfolios: resilient multi-orbit communications, sovereign PNT, persistent intelligence surveillance and reconnaissance (ISR), and space domain awareness (SDA), and in some cases missile-warning and defense architectures built on massive proliferated Low-Earth Orbit (LEO) layers.

Who Will Spend the Most? A Reality Check

Even as the U.S. remains the heavyweight of global space spending, the world is shifting toward a multipolar space economy. China, Europe, Japan, India, and others are scaling civil and defense programs at unprecedented speed.

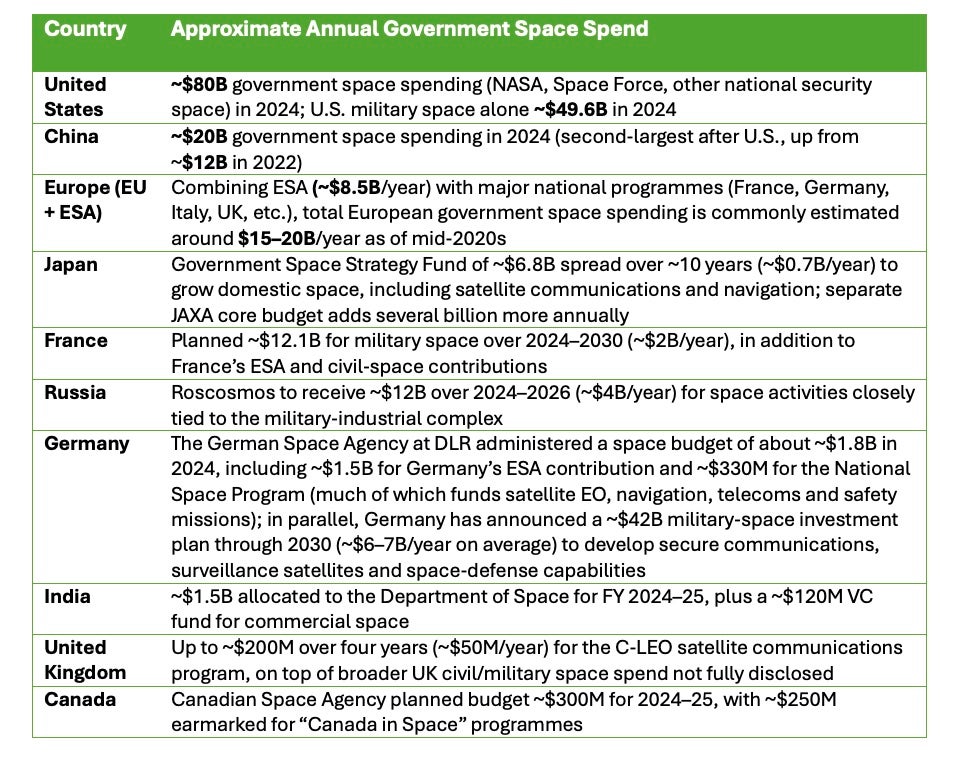

By ~2030, the top sovereign investors will likely include: the United States, investing $95 billion to $110 billion per year; followed by China with an investment of $25 billion to $30 billion per year. Other leading countries are Japan, France, Russia, Germany, India, the United Kingdom, and Canada.

In Europe, combining the European Space Agency (ESA) spend of around $8.5 billion per year with major national programs, total European government space spending is estimated around $15 billion to $20 billion per year as of the mid‑2020s.

By the early 2030s, more sovereign constellations will join the existing commercial constellations in carrying the bulk of global secure data traffic, imagery, and navigation signals. Proportionally the sovereign infrastructure and increasingly capture share, positioning those assets as infrastructure, and making control of them a core determinant of national power.

The trend is unmistakable: space power is becoming more distributed, more strategic, and more contested.

Agile Space Players: The Engines of Sovereign Ambition

A decade ago, sovereign space ambitions would have stalled under traditional aerospace timelines. Today, a new breed of agile space players — lean, capital-efficient, digitally engineered — are redefining what governments can buy and how fast they can deploy it.

Europe, Japan, Korea, India, and other geographies are fostering rapid growth, incentivizing agile space players to drive how constellation proliferation takes place.

These companies raise capital to build platforms ahead of demand, iterate hardware rapidly, defy traditional production timelines leveraging additive manufacturing/ 3D printing, and use modular buses and standardized interfaces to scale at industrial speed. They also convert data into multi-year recurring revenue streams, and engineer themselves to be sovereign-compatible across IP, manufacturing, and data residency.

They are no longer niche disruptors — they are the execution backbone of national space strategies.

Strategic Choices

Aerospace and defense leaders face pivotal decisions that will define their relevance in a sovereign-space era.

Role ambition: Remain a specialist and risk losing the customer interface, or move up the stack into integrated space-infrastructure roles that require more capital, more capability, and more strategic exposure.

Legacy space industry leaders must decide if the cost of hesitation is worth the price. Namely, for incumbents in the space industry, standing still is not neutral. Every year of delay cedes market share and mindshare to so called “New Space” platforms that are becoming default solutions. Increasingly vertically-integrated, lower-cost, full-service solutions have become exceptionally attractive to the sovereign buyer looking to move fast. Legacy players could be locked into legacy orbits and architectures, with a narrower role to low‑margin hardware supply.

Vertical Integration: Some layers cannot be outsourced. Secure platforms, ground networks, and classified analytics environments demand either direct ownership or extremely tight partnership models. That said, the core strategic choice players need to consider making is whether or not to vertically integrate. Which capabilities a player should make versus buy in order to keep architectures flexible while compressing development timescales and driving down unit costs is the fundamental choice for larger legacy players. New Space players are already exploiting these advantages at scale.

Capital and Dealmaking: Companies must rebalance portfolios, trading share in lower-growth segments for exposure to higher-growth areas like platforms and data—while navigating export controls, FDI screening, and IP barriers. As legacy players and agile new entrants shape their business development to capture sovereign constellation proliferation, they need to choose their organic and inorganic growth levers as carefully as they choose printed circuit boards and semiconductor chips, keeping in mind everything from operating margin to national security.

Operating Model Transformation: Sovereign customers expect speed, resilience, and life-cycle accountability. Digital engineering, flowline production, and modular architectures are becoming prerequisites, not differentiators. Top-heavy organizations, high-span of control for engineering decision making, waterfall program management methodology, and engineering milestone cycles beyond two weeks are the old way of doing business. Slow processes must go by the wayside and transforming your operating model is no longer optional. For any company in any nation to succeed at capturing sovereign constellation proliferation, how you make what you make is critical now more than ever.

Accelerating the Sovereign Space Journey

Companies can turn sovereign ambitions into sustainable value by providing:

- Sovereignty-aligned strategy and portfolio design by clarifying role ambition, integration strategy, and capital allocation.

- M&A, joint ventures & ecosystem architecture, by identifying partners, qualifying transactions, and structuring alliances within strict regulatory and geopolitical parameters.

- Business model engineering by designing scalable, commercially viable models suited for sovereign-grade delivery.

- Applying rigorous controls, risk management, and performance governance to multi-launch, multi-vendor constellation architectures.

- Building dual-sourced, geopolitically aware supply chains and moving factories from prototypes to serial production.

- Helping companies reposition around sovereign and defense-driven growth opportunities while protecting cash and mitigating downside risk.

Space sovereignty is no longer theoretical, it is reshaping global industry, alliances, and power balances today. Governments are moving quickly. Capital is flowing. Industrial capability is consolidating.

The companies that align ambition, integration strategy, and execution excellence will anchor the next era of the global space economy. The ambitious sovereigns seeking to proliferate rapidly, bolster resilience, and deepen their industrial base can achieve these goals by meeting the agile space ecosystem where it is: with tactical flexibility and continued bold ambition.

This article was contributed by the team at AlixPartners. Sita Sonty is Partner and Managing Director, Global Space and Satellite Leader. Diane Shaw is Partner and Managing Director, Space and Satellite Sector. Harry Malins is Partner, Space and Satellite Sector, and David Owusu-Gyebi is Vice President of Strategy and Analysis.

AlixPartners is a results-driven global consulting firm that specializes in helping businesses successfully address their most complex and critical challenges. Founded in 1981, AlixPartners is headquartered in New York and has offices in more than 20 cities around the world.

Stay connected and get ahead with the leading source of industry intel!

Subscribe Now