Latest News

Photo: OneWeb

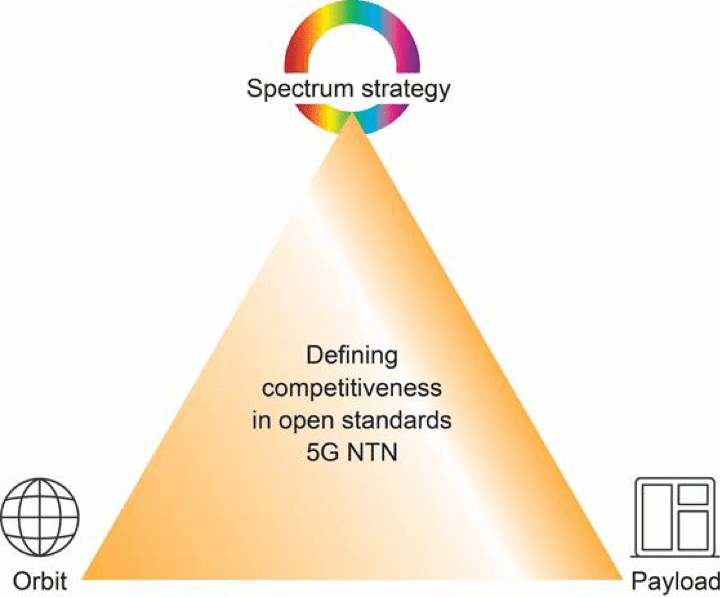

In our recent column, we proposed a golden triangle of competitive differentiation in the satcom industry, comprising advantageous configurations of orbit, spectrum and payload to host a subset of 5G satcom services within a unified “network of networks.”

With the LeoSat shutdown, and OneWeb and Intelsat recently filing for Chapter 11 bankruptcy protection, it seems timely to revisit that golden triangle and ask what it tells us about the future for 5G satcom investors.

While we didn’t see the writing on the wall for OneWeb, we were very clear that it would be difficult to be commercially successful in the NGSO consumer broadband market. Since then, OneWeb’s primary investor Softbank apparently concluded that making a success of the company’s combination of Ku- Ka-band spectrum and a NGSO orbit to deliver broadband services would have been a tough gig. Bearing in mind that the OneWeb event follows LeoSat investors reaching a similar conclusion towards the end of 2019, it will be fascinating to see what new ideas will emerge from prospective investors now circling around OneWeb’s Non-Geostationary Orbit (NGSO) assets.

Since our last column, Intelsat has also filed for Chapter 11, in a move clearly linked to maximizing the value of their C-band spectrum rights, and Ligado has been given a long-awaited go-ahead to rollout a 5G network incorporating hybrid terrestrial and GEO satellite services in L-band. These are significant developments that will help to shape the evolution of 5G convergence, but it is undoubtedly the case that satcom investors have taken a bumpy ride on the journey to 5G nirvana. The repurposing of incumbent spectrum rights is a hugely important part of the satcom 5G puzzle; possibly the most important element and certainly the primary battleground for today’s investors.

Photo: TTP

While OneWeb had set its sights on the broadband market, other NGSO operators developing Internet of Things (IoT) services in sub- 6 GHz spectrum have continued to meet recent funding goals, albeit at lower orders of magnitude. Perhaps, according to recent events, the prohibitive scale of investment required to build a Low-Earth Orbit (LEO) broadband service will cause NGSO investors to put sharper focus on the 5G IoT opportunity?

And once the dust settles over the question as to which orbit/spectrum configurations are most investable for the provision of 5G satellite broadband and IoT services, differentiated payload strategies will become the next axis of differentiation between competing operators. Only time will tell how many NGSO constellation are really needed to fulfill the needs of a unified, global 5G network of networks. But since there is not a one-size-fits-all solution to every 5G use case, it will be fascinating to continue speculating how this complex patchwork will finally be knitted together.

Putting in place an open standards framework to support that complexity is no mean feat, and the 3GPP community still has its work cut out to maintain pace on the standardization effort for integrated Non-Terrestrial Networks (NTN) in Release 17 and Release 18. That task, somewhat inhibited by our current COVID-19 situation, must also be completed to drive returns to those investing in 5G space infrastructure. But standards alone are by nature undifferentiated, and it is pertinent for 5G network operators to ask how these standard protocols and waveforms can be leveraged to extract maximum value from their own variant of the golden triangle.

Just for now, let’s keep a watching brief on the OneWeb assets as a retesting of investment appetite for 5G NGSO broadband. Whatever the direction of travel of the industry from here on, and despite the current focus on satellite spectrum assets, it is important to bear in mind that a successful endgame must encompass all three pillars of the golden triangle (spectrum, orbit and payload). Even a small mismatch to market expectations can impair business cases and dominance in just one of the pillars will be insufficient for clinching the advantage.

Editor’s Note: An earlier version of this article mischaracterized LeoSat’s shutdown and business strategy.

Peter Kibutu and Adrian Hillier are consultants for The Technology Partnership (TTP).

Get the latest Via Satellite news!

Subscribe Now