ATK Merges Aerospace and Defense Group with Orbital Sciences

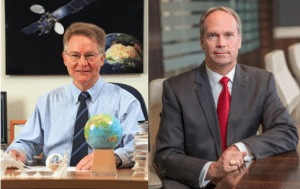

Orbital Sciences President and CEO David Thompson on the left, and ATK President and CEO Mark DeYoung on the right. Photos: ATK and Orbital Sciences

[Via Satellite 04-29-2014] Citing key synergies between the two companies, Orbital Sciences and Alliant Techsystems (ATK) have announced a $5 billion merger to create one unified aerospace and defense company. Orbital ATK, as the new company is to be called, pools together ATK’s aerospace and defense groups with Orbital Sciences. Together, Orbital ATK will employ 13,000 people and — based on 2013 financial results — have combined annual revenue of $4.5 billion. Orbital Sciences will become a wholly-owned subsidiary of ATK by the end of the transaction, which is expected to close by the end of 2014.

David Thompson, president and CEO of Orbital Sciences will take on the role of president and CEO of Orbital ATK. Mark DeYoung, president and CEO of ATK will shift to a new role as chairman and CEO of ATK’s Sporting Group, which will be headquartered in Utah and is expected to employ close to 5,800 people. Orbital ATK will be headquartered in Dulles Va., where Orbital Sciences is currently located.

“We are creating two strong, standalone companies committed to sustained leadership and success in their markets,” said DeYoung. “Orbital has been a customer of ATK for more than 25 years; we are familiar with each other and each company’s capabilities, and our respective cultures share a commitment to innovation and excellence. This alignment provides a solid opportunity to deliver great products to our customers at affordable prices with the opportunity to capture significant synergies.”

Three of the five business areas on which Orbital ATK is to focus are categorized as aerospace and aeronautics. Rocket propulsion systems will comprise 25 percent of company revenue and is expected to leverage strengths from both entities. Satellites and space systems will make up 22 percent, drawing heavily from Orbital Sciences, whereas airspace structures and components will come primarily from ATK, contributing 13 percent. The remaining 40 percent of revenues are anticipated to come from defense products.

The combined company will mesh Orbital Science’s satellite products and launch vehicles with ATK’s rocket propulsion, composite structures and space power systems. This could open new doors in Orbital Science’s hunt for new engines. The company is actively looking for alternatives to the Russian engines that power the Antares rocket, and recently dropped its lawsuit against United Launch Alliance (ULA) over the RD-180 engine. Thompson mentioned other projects that the merger will enable during a webcast that quickly followed the announcement.

“Looking a little bit longer term, beyond just the next couple of years, we also foresee in the second half of the decade opportunities for several major new programs that probably would not have been realistic for either Orbital or ATK to include on our own,” he said. “These include examples such as the next generation ICBMs, and also in-space satellite servicing on a broader scale than has been done in the past.”

The company expects annual revenue and cost synergies of $220 to $300 million by 2016. Incremental annual revenue contributes $150 to $200 million of this number, and annual cost reductions comprise the remaining $70 to $100 million. Orbital ATK has a total contract backlog of $11 billion, of which $3 billion are unexercised options from Orbital Sciences and $0.2 billion from ATK Aerospace and Defense.

“Over the next three years the lion-share of our expected growth is either in backlog today or in the proposal phase that should translate into new contracts before this year is out,” said Thompson.

Retired U.S. Air Force Gen. Ronald R. Fogleman, chairman of ATK’s board of directors, will chair a new 16-member board, which includes seven members from ATK and nine from Orbital Sciences. Both boards unanimously approved the merger, reportedly after several months of discussions. Shareholders of Orbital Sciences will own approximately 46.2 percent of the new company and ATK shareholders will own 53.8 percent. Until the transaction closes, both companies will continue to operate separately.