Latest News

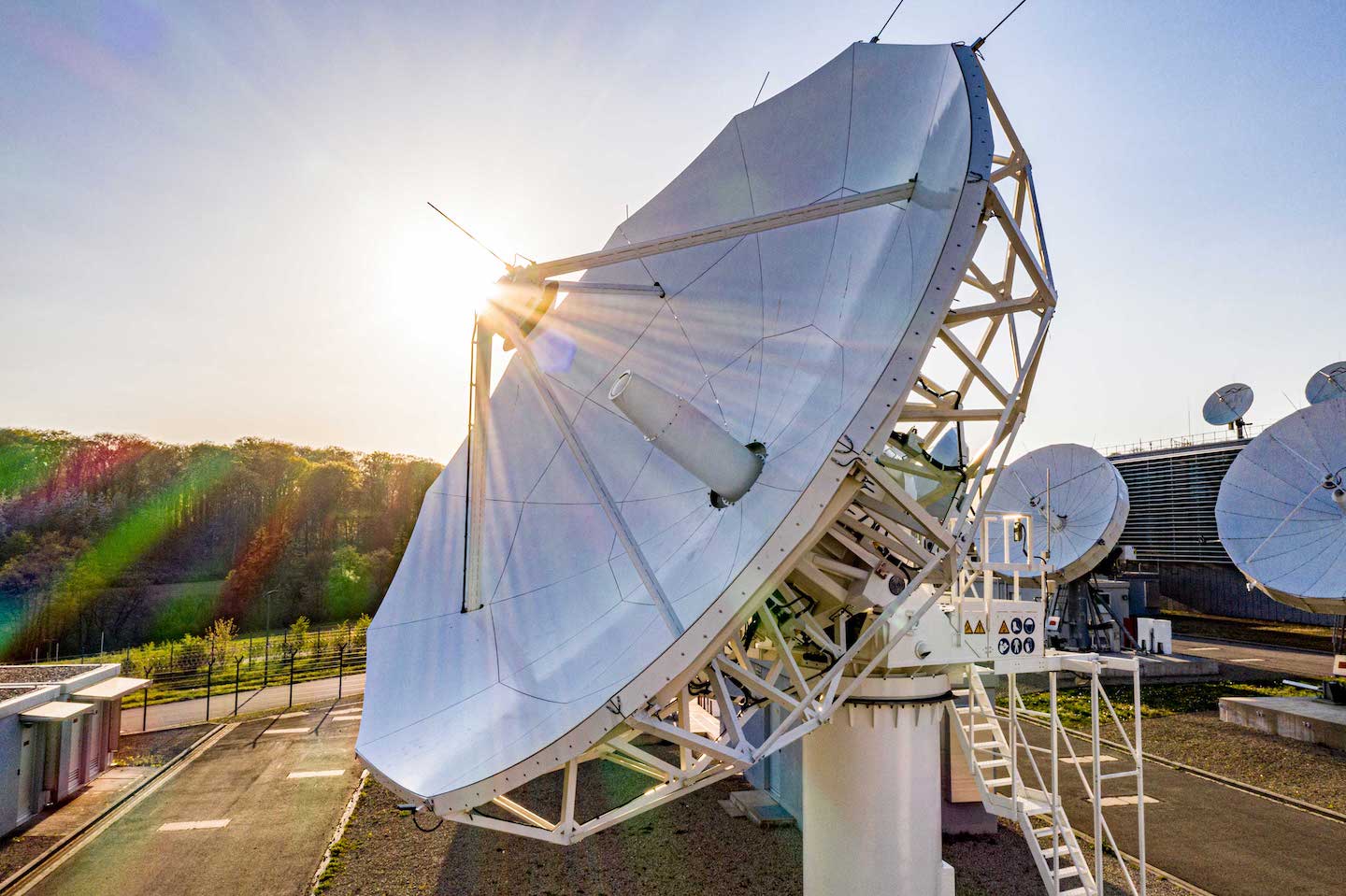

SES headquarters in Luxembourg. Photo: SES

Moody’s Ratings changed its outlook on satellite operator SES from “stable” to “negative” on Tuesday, citing increased competition in the satellite industry putting pressure on prices.

Moody’s explained its rationale for the change, noting there is a risk of oversupply in satellite connectivity with Non-Geostationary Orbit (NGSO) satellites. Moody’s said that while SES is not in the consumer broadband market, a surplus of satellite capacity in the consumer broadband market could be directed to markets where SES has a strong position such as maritime, aviation, and government.

On a more positive note, Moody’s noted that SES’ position in multi-orbit offerings is a differentiator, along with its place as a trusted partner for U.S. and European governments.

“The outlook change to negative reflects the increased risk in terms of operating performance and deleveraging path of the combined SES and Intelsat entity, owing to growing competition and higher innovation risk in the satellite industry,” says Ernesto Bisagno, a Moody’s Ratings Vice President – Senior Credit Officer and lead analyst for SES.

“These considerations are impacting the business risk of the combined entity, and as a result, we have tightened the leverage tolerance for the rating, which further weakens the company’s position within the Baa3 category,” Bisagno added.

Moody’s affirmed SES’s Baa3 long-term issuer rating and its ba1 Baseline Credit Assessment (BCA).

SES issued a market update in response to Moody’s release, ahead of its full-year financials later this month. SES is targeting that its full year revenue will be at the top end of its outlook, with adjusted EBITDA above the outlook range of 950 million euro to 1 billion euro ($992 million to $1.04 billion).

Stay connected and get ahead with the leading source of industry intel!

Subscribe Now