Latest News

Iridium’s Satellite Network Operating Center (SNOC). Photo: Iridium

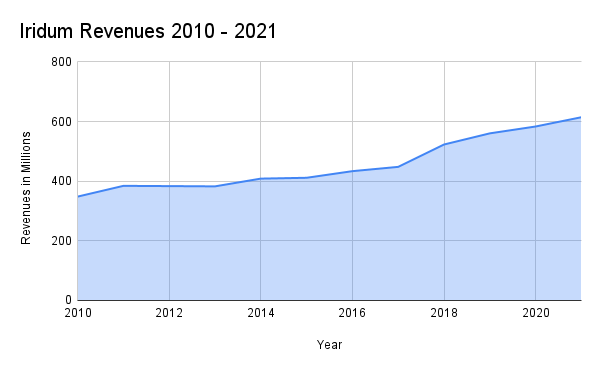

Iridium Communications reported record revenue in 2021, continuing an eight-year revenue growth streak. The company released its full-year 2021 financial results on Feb. 17, reporting $614.5 million in revenue, which was up 5% from the year-ago period.

The company saw record subscriber growth in 2021 as well, ending the year with 1,723,000 total billable subscribers, up 17% from the year prior. Iridium said this subscriber growth was driven by commercial IoT.

“2021 exceeded our expectations,” CEO Matt Desch said on Thursday’s investor call. “As with many companies, we were not entirely sure what to expect at the outset of the year, but we continue to see strong partner and subscriber activity across all our business areas and continue to develop and launch a number of new services that we expect to deliver meaningful subscriber and revenue growth over the next decade.”

This financial performance follows after strong financial results in 2020, when Iridum reported record revenue of $583.4 million, and 14% subscriber growth over 2019. Iridium has increased revenues each year for the past eight years.

“The last two years have certainly demonstrated that Iridium’s business model can weather most any environment. Our services are mission critical for enterprises and governments around the world. And we have shown consistent strong growth and resilience really over the last 20 years during economic downturns, geopolitical disputes and now even a global health pandemic,” Desch said.

Credit: Via Satellite

Net loss in 2021 was $9.3 million, or $0.07 per diluted share, compared to net loss of $56.1 million, or $0.42 per diluted share, for 2020. Iridium said this was due to higher revenue, a reduction in debt extinguishment costs, and lower interest expense. OEBITDA for 2021 was $378.2 million, a 6% increase from $355.6 million in the prior year, representing an OEBITDA margin of 62%.

Service revenue is the largest portion of Iridium’s business, with $491,991 in revenue in 2021, up 36% compared to 2020. Growth came from IoT Data, with revenues up 14% compared to 2020, and Broadband, with revenues up 20% compared to 2020. Desch told investors he expects IoT and Broadband to remain key growth drivers in the future.

Iridium’s commercial IoT subscribers grew 24% from the year-ago period to 1,193,000 customers, driven by continued strength in consumer personal communications devices. IoT Data subscribers now represent 76% of billable commercial subscribers.

Government service revenue grew 3% over 2020 to $103,887. Iridium’s U.S. government business ended the quarter with 147,000 subscribers, which compares to 152,000 for the prior-year quarter. The company said subscriber counts continue to be negatively affected by the government’s internal service pricing levels, created as a result of a shift in contract administration between agencies.

Iridium initially expected subscriber equipment sales to be flat in 2021, but the company grew sales 7% over 2020 to $92,000. The company expects higher levels of equipment sales in 2022 than in 2021, even as issues continue with parts availability.

Iridium issued guidance for 2022, expecting total service revenue growth between 5% and 7%.

Desch told investors he has strong confidence in Iridium’s growth projections and its ability to compete in the changing satellite industry.

“We have avoided the commodity markets that our other satellite networks continue to chase and we have supplied critical cost effective communications for a diverse set of industries and use cases,” Desch said. “While there is a lot of investment in our industry lately, it’s primarily going towards commodity broadband suppliers in Ka- and Ku- band that are not really able to effectively compete in Iridium’s various personal communication markets. This means we have good visibility into market dynamics and it gives us a strong level of confidence in our growth projections.”

Stay connected and get ahead with the leading source of industry intel!

Subscribe Now