SES Yields Net Profits in Q1, Launches Share Buyback Program

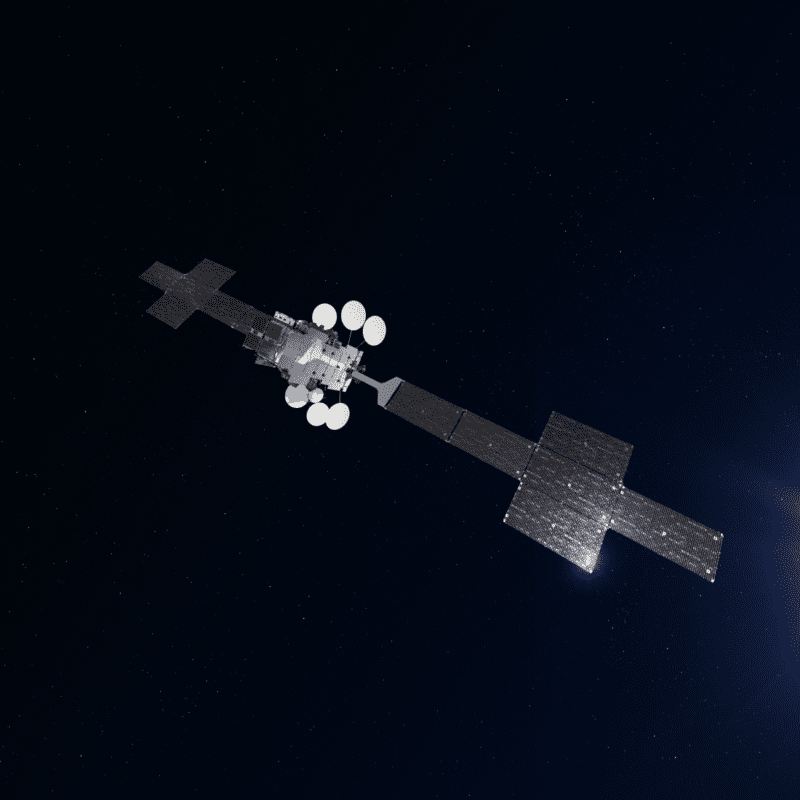

Artist rendition of SES-17. Photo: Thales Alenia Space

SES is launching a 100 million euro ($120.5 million) share buyback program after turning in what it viewed as a stronger-than-expected performance in the first fiscal quarter of 2021.

The operator’s biggest wins for the quarter were: a 42% year-over-year increase in adjusted net profits to 75 million euros ($90.3 million); a 7% reduction in recurring operating expenses from the same period in 2020, and $180 million of backlog signed in the quarter for SES-17 and O3b mPOWER.

SES-17 is scheduled to launch in the second half of 2021. SES CEO Steve Collar said he was excited by the level of market interest in O3b mPOWER that the company has been seeing across all verticals.

“These important growth investments allow us to offer a significantly expanded set of low latency products and solutions to the market as the world emerges from the COVID environment and demand for connectivity increases exponentially,” said Collar.

SES Video division revenues declined 4.6% year-over-year compared to the same period in 2020. The operator reported that it generated higher revenues across international markets and saw growth in the number of paying consumers subscribing to HD+ in Germany.

SES Networks’ Q1 revenue of 173 million euros ($208 million) was flat year-over-year, with growth in government business offset by COVID-related declines in mobility services.

Additionally, Collar said that the operator remains on course with its efforts to clear C-band in the United States for 5G use and hit required milestones for spectrum payouts from the FCC. Collar discussed these efforts in an August 2020 interview with Via Satellite.

“The share buyback program that we are announcing today reflects our confidence in the long-term fundamentals of the business,” said Collar. “The current share price does not reflect the underlying value of SES.”

Analysts expressed similar sentiments about the value of SES’ stock in September, predicting long-term growth opportunities for SES despite COVID-related headwinds in the mobility markets.