Hughes Revenue up 3.8% in Q1, Despite 25K Subscriber Loss in the US

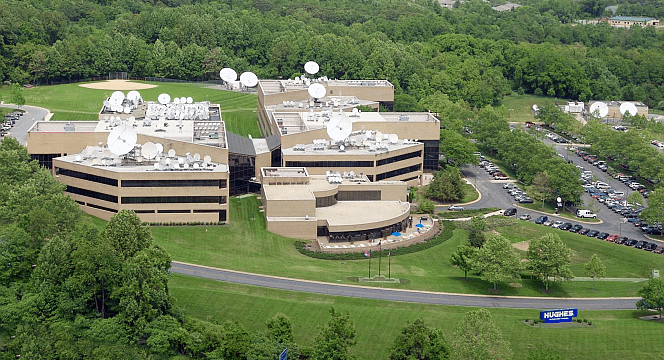

Hughes Network Systems campus in Germantown, MD. Photo Credit: Hughes

Hughes Network Systems saw a 3.8% revenue increase in the first quarter of 2021, despite a dip in subscribers. During quarterly reports for parent company EchoStar Corporation, Hughes also provided an update that the Jupiter 3 satellite launch is still on track for launch in the second half of 2022.

For the first quarter, EchoStar reported consolidated revenues of $483 million, an increase of 3.6% over the same time period in 2020, driven by higher sales of broadband services to our consumer customers. Net income increased $135.3 million to $77.6 million. The increase was primarily due to higher operating income and higher gains on investments

Revenue attributable to Hughes — which makes up most of the company’s revenue — was $476 million. The Hughes segment Adjusted EBITDA increased $39.7 million year-over-year, which the company said was driven by higher gross margin associated with the growth in its consumer broadband service revenue and lower selling, general, and administrative expenses.

Yet this was the second quarter in a row of subscriber loss, after a string of increased subscribers earlier in 2020. Total Hughes broadband subscribers were 1,553,000 as of March 31, 2021. This is down 11,000 from the previous quarter.

The decrease came from a decline in U.S. subscribers of 25,000 subs. This was offset by a boost in Latin America subscribers of 14,000. Total subscribers in the U.S. are at 1,164,000 and total subscribers in Latin America are at 389,000.

Hughes President Pradman Kaul commented on the subscriber decrease in the U.S. during Thursday’s investor call.

“Subscriber base in the United States declined by approximately 25,000 — but that’s not the whole story,” Kaul said. “Hughes retail ARPU continues to increase due to the high demand for broadband services. While we continue to operate at peak capacity, we are managing our sales activity to optimize service to our existing subs, and we expect these trends to continue in the near term.”

Kaul also said that the company has not seen an impact to date from SpaceX’s Starlink internet beta testing: We’ve had no impact to date obviously from [Starlink] because all they’ve been doing is running a beta program. They haven’t actually started implementing an operational program.”

The Jupiter 3 satellite will deliver more capacity to capacity-constrained North America after it launches in the second half of 2022. There were no further delays announced, and the launch date is in line with expectations from the previous quarter. The Jupiter 3 program has been pushed multiple times, and Kaul said that Hughes is working closely with manufacturer Maxar Technologies to recover the schedule without risks to the satellite.

Kaul said Hughes believes there is a large “pent up demand” for new subscribers for consumer broadband, and Hughes believes it will be able to quickly use the full capacity of Jupiter 3.

Maxar CEO Dan Jablonsky commented on the Jupiter 3 build in the company’s quarterly report earlier in the week. “We don’t believe there are any development risks associated with the program anymore,” Jablonsky said. “There is one particular vendor that’s the bottleneck on one particular set of parts across the border. And we are working with them, and they’ve been a little bit hampered by COVID. But the products are delivering. They’re not delivering at the pace we had originally expected, but things are on track now.”

Also in the investor call, Kaul addressed the recent Eutelsat investment of $550 million in OneWeb. He reiterated Hughes confidence in OneWeb, of which it is an investor, but would not comment further if Hughes is contemplating a greater investment in OneWeb’s ongoing funding raise.