Quilty Analytics: NGSO Constellations Face Revenue ‘Challenge’ for Attractive ROI

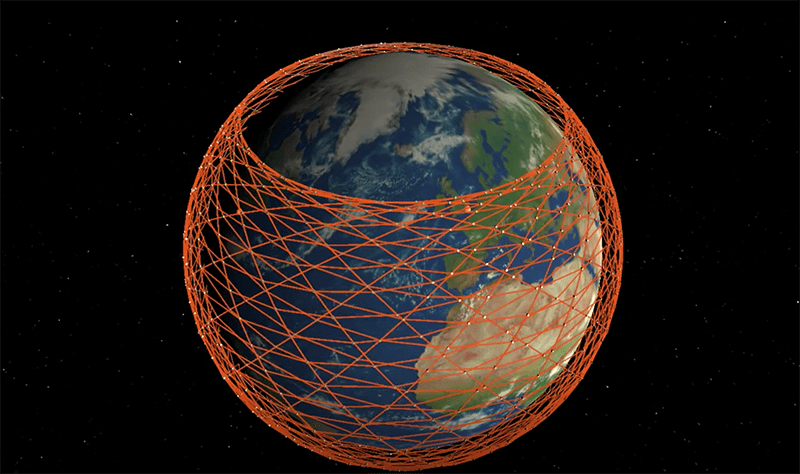

Starlink visualization. Photo: Mark Handley, University College London

A recent Quilty Analytics report outlines that satellite constellations in Non-Geostationary Orbit (NGSO) like Amazon’s Project Kuiper, SpaceX’s Starlink, and OneWeb’s constellation, will need to generate about $600 million in average peak year revenue for each $1 billion in CapEx to realize attractive ROI. For $20 billion in CapEx, the average peak year revenue number would be about $12 billion, according to the report.

Quilty estimates the entire satcom industry generates about $6 billion in wholesale capacity revenue supporting broadband data services and these new Low-Earth Orbit (LEO) systems “could face the challenge of having to triple this revenue by the end of the decade to realize an attractive ROI.”

Recent developments in NGSO constellations — like the recent FCC approval of Amazon’s Project Kuiper constellation and Amazon’s subsequent $10 billion investment — “represents a seismic jolt for the satcom and space industry,” writes Chris Quilty, Partner of Quilty in the latest Satcom Quarterly Briefing: NGSO Broadband Satellite Constellations – Their Markets and Prospects for Success.

“The industry has now made combined commitments to new/expanded NGSO broadband constellations exceeding $20 billion – a spectacular level of financial support for businesses that have zero revenue today except for O3b which began service in 2014,” Quilty writes.

The report outlines telcos, consumer broadband, and government and defense as the most promising customers for NGSO capacity, and predicts Starlink and Project Kuiper will try to compete directly with terrestrial broadband versus just targeting customers in rural areas.

In addition, Quilty expects satellites in Geostationary Orbit (GEO) and NGSO systems to coexist throughout this decade: “GEOs will be bolstered by new VHTS (Very High Throughput Satellite) capacity but are still likely to play an increasingly smaller role in broadband while remaining relevant in video distribution as linear TV viewing continues its slow decline. We believe this video assessment was a factor in Intelsat and SES’s recent order of a combined 12 C-band satellites to serve U.S. broadcast markets and meet FCC’s C-band spectrum clearing deadlines supporting U.S. 5G implementation.”