CBA Exec: T-Mobile Proposal is “Pure Mischief”

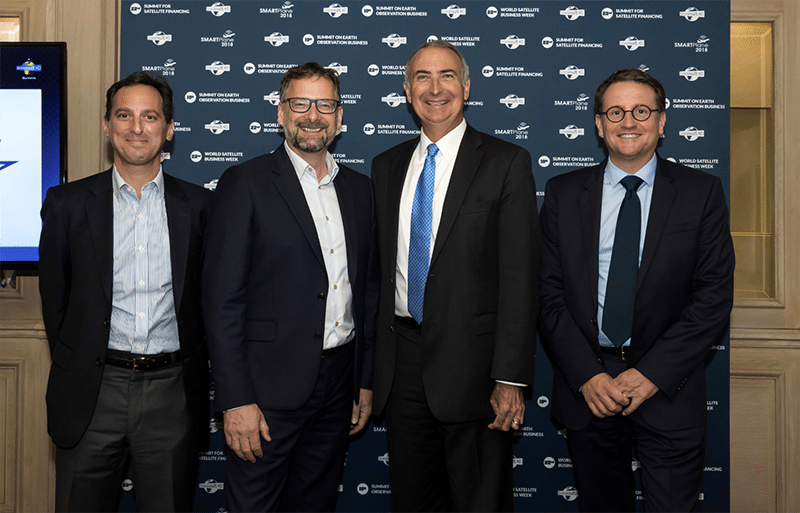

Daniel Goldberg (Telesat), Steve Collar (SES), Stephen Spengler (Intelsat), Rodolphe Belmer (Eutelsat). Photo: Business Wire

The C-Band Alliance (CBA), containing SES, Intelsat, Eutelsat, and Telesat, is still optimistic that its proposal for the re-allocation of valuable C-band spectrum in the United States will be successful. However, anyone who thought this would be a rare event where the wireless and satellite industries work together, may have to take a step back. T-Mobile (T-MO) sent a letter to the FCC urging them to reject the CBA’s proposal. T-Mobile would like to see an incentive-based auction take place in the 3.7 to 4.2 GHz band, which could ultimately see wireless players acquire spectrum in this band.

In its hard-hitting letter to the FCC, T-Mobile goes on to say that the members of the C-Band Alliance “have no plans to put the 3.7 to 4.2 GHz band to use for terrestrial services. Instead, they seek to enlist the Commission’s assistance for one reason — to sell spectrum that they acquired for free for potentially billions of dollars — an enormous transfer of wealth away from the public for an amount of spectrum on which the C-Band Alliance will unilaterally decide.”

The C-band Alliance was formed by the four satellite operators that provide the vast majority of C-band satellite services in the U.S. The CBA has proposed to the FCC, what it calls, a breakthrough market-based proposal to clear portions of this C-band spectrum to support the introduction of 5G services in the U.S. This proposal also protects the valuable satellite-delivered services provided by C-band. In an exclusive interview, Preston Padden, the CBA’s head of advocacy and government relations, talks about T-Mobile’s latest moves, and what it could mean for the satellite industry.

VIA SATELLITE: T-MO is aggressively pitching for C-Band spectrum. Have you been surprised by their aggressiveness? Is there any hope for future cooperation between the telecom and satellite industries?

Preston Padden: We still believe strongly in cooperation between wireless and satellite. T-MO is an outlier. The CBA proposal is founded on the concept that these two industries can and should work together.

VIA SATELLITE: You used the term ‘spiteful attack’ in your statement. This is strong language. Has this battle (if that is the right word) escalated to a level which is no longer healthy?

Padden: The “refined” T-MO plan is not a serious proposal. It is pure mischief making designed to delay the repurposing of C-band spectrum. Once the Sprint/T-MO proposal is approved, the new T-MO will be the only U.S. carrier with sufficient mid-band spectrum to launch 5G beyond the dense urban areas. That is an advantage T-MO would like to maintain by delaying the repurposing of C-band.

VIA SATELLITE: How optimistic are you that the FCC will ultimately see the value in the CBA approach? Given T-Mobile’s size and influence on the US communications landscape, is this an incredibly worrying sign for the satellite industry?

Padden: We believe that the FCC will see the T-MO proposal for what it is. CBA has put on the table a thoughtful and workable plan to achieve the twin public interest goals of repurposing spectrum for 5G and continuing to serve vital existing C-band customers. No other plan achieves these twin goals.

VIA SATELLITE: Do you believe other wireless players in the U.S. share T-Mobile’s aggressive approach?

Padden: The CBA is working cooperatively with other carriers and other interested bidders to reach a consensus on the many technical issues involved in deploying 5G wireless in a portion of the C-band.

VIA SATELLITE: What are your major issues with T-Mobile’s new proposal? Why is it such bad news? Do you think the FCC will seriously consider it?

Padden:The ‘refined’ T-MO proposal is ridiculously complicated and totally unworkable. It was a stunning achievement for CBA to forge a consortium of C-band satellite operators. T-MO blithely proposes the fanciful notion that tens of thousands of satellite dish owners will form 416 different consortiums to clear spectrum. It is not a serious proposal. And T-MO’s proposal would require 5G signals to stop magically at the borders between each Partil Economic Area (PEA). In fact, the 5G signals will cross those borders causing interference with satellite dishes in adjacent PEAs. T-MO’s plan will evict current C-band customers from C-band distribution — including influential broadcasters, a politically untenable result. Finally, the CBA plan effectively provides a 300 MHz guard band between the 5G operations and radio telemetry systems that operate in the 4.2 to 4.4 GHz band. Clearing the vastly larger amounts of spectrum proposed by T-MO would create a serious risk of interference causing altimeter radars to yield false altitude readings.

VIA SATELLITE: What do you believe is the timeline for what happens next?

Padden: China, South Korea, Japan, much of Europe, and Australia have awarded mid-band spectrum to their carriers. China boasts that they will deploy 10,000 5G base stations by 2020. Keeping the U.S. in the race to 5G is a national priority for both economic and national security reasons. All of the foregoing means that the FCC hopes to move as quickly as it can.

VIA SATELLITE: There was a feeling that the CBA’s proposal could win, given there wasn’t a serious competing proposal. Has that now changed?

Padden: There still is no serious and workable alternative to the CBA plan.

VIA SATELLITE: What would the ramifications be for the satellite industry if T-Mobile’s proposal was successful? If the satellite industry was to lose access to the 3.7 GHz and 4.2 GHz strip of spectrum, what would this mean for broadcasters?

Padden: It is hard to answer this question because the T-MO plan is not feasible. And it is politically untenable to talk about kicking the broadcasters out of C-band.

VIA SATELLITE: Was it naïve to think the satellite industry and telecoms industry could work together harmoniously on such a contentious issue such as this?

Padden: No. Not at all. The CBA plan is a win-win for both industries.

VIA SATELLITE: Finally, what do you think will happen next? How optimistic are you that the CBA’s proposal will ultimately prevail?

Padden: The CBA plan is voluntary, common sense, and a good faith plan. It will prevail.