Latest News

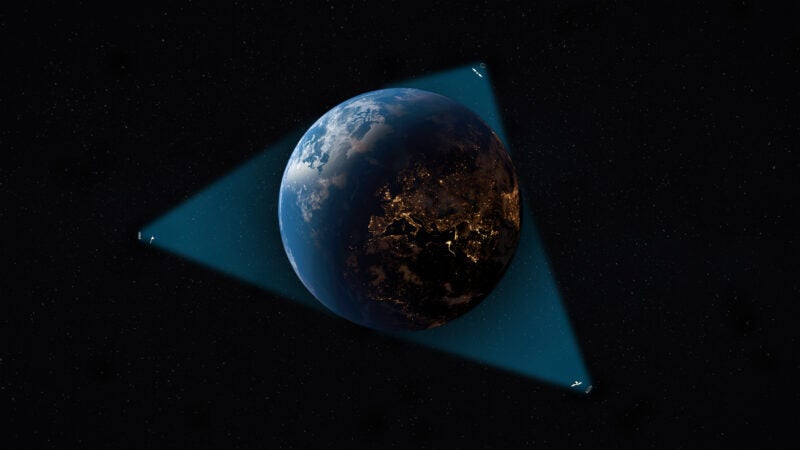

The ViaSat-3 constellation. Photo: Viasat

Viasat reported stronger than expected year-over-year revenue growth in the first quarter of its 2026 fiscal year, with growth coming from its Defense and Advanced Technologies (DAT) segment.

On the ViaSat-3 constellation, the window for the expected entry into service date for the third satellite has shifted out. It’s now targeted for early to mid-2026, after it was expected in early 2026.

The second satellite, ViaSat-3 F2 is expected to ship to the launch site by the end of September, and is targeted to enter service in early 2026.

After the first ViaSat-3 satellite mostly failed and is delivering just a fraction of its anticipated capacity, the operator said each of the two upcoming satellites will give Viasat more capacity than its entire existing fleet.

CEO Mark Dankberg told investors the operator is continuing “to monitor the launch manifest and range priorities for our launch vehicles at Cape Canaveral,” and Viasat adjusted the projected in-service date “to better reflect various potential schedule uncertainties post shipment for Flight 3.”

Viasat’s revenue of $1.2 billion in the first quarter was up 4% year-over-year. The defense segment DAT grew revenue 15% year-over-year to $344 million with increases in information security and cyber defense particularly in high assurance encryption products, and in space and mission systems, driven by antenna systems.

Revenue in the Communication Services segment was flat year-over-year at $827 million. Within the segment, aviation revenue grew 14% year-over-year to $293 million.

Viasat added 100 commercial aircraft in service during the quarter, and 100 business aviation aircraft as well. Its backlog for commercial aircraft declined slightly on a sequential basis from 1,600 aircraft to 1,580 as new planes are installed.

Defense Spin-Off Potential

Last week, an activist investor issued an open letter advocating that Vasat spin-off or IPO the DAT business, calling it undervalued.

Dankberg didn’t talk specifically about the proposal, but said in terms of portfolio review, Viasat looks at the synergy between its businesses, noting that space capabilities are being more integrated into different systems, both commercial and government.

“I’ll give you an example of a couple of areas that are converging. It’s become more and more evident especially for large constellations, one of the single failure modes common to an entire constellation is cybersecurity. One of the elements of our [cryptographic] business deals with the intersection of cyber and space. That’s one where there could be an example of increasing synergy.”

Viasat also looks at the capital needs of both businesses, Dankberg said, and there is a focus to reduce the capital intensity of the communications business so the two have “more common capital needs.”

Stay connected and get ahead with the leading source of industry intel!

Subscribe Now