New Euroconsult Report Forecasts Exciting Changes in the Satellite Industry

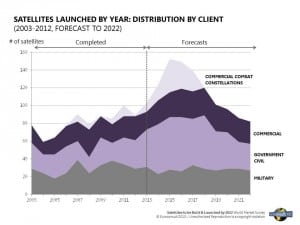

[Via Satellite 11-08-13] Changes are afoot in the satellite industry, and analysts at Euroconsult have detailed them in a new report titled “Satellites to be Built & Launched by 2022, World Market Survey.” The consulting firm expects 1,150 satellites, worth a collective total of $263 billion, to be launched over the next 10 years. Three quarters of these satellites will be replacements, but the next generation of spacecraft will not look the same as those in orbit now.

According to the report, the total cumulative mass for satellites is growing by 31 percent compared to last decade. But despite the increase in number, Euroconsult expects revenue growth to be lower than the growth in the number of satellites.

“Many small satellites are being developed, requiring shorter development time and lower launch costs,” said Rachel Villain, principle advisor at Euroconsult. “On average each satellite is smaller at 2.1 tons (vs. 2.2 Tons). This average aggregates a growing number of small satellites (< 500 kg) from newcomer countries and smaller replacement satellites in LEO in established space countries.”

This change in mass is opening up doors for more countries to enter the satellite industry. Governments are expected to contribute two thirds of the 1,150 satellites to be launched, responsible for nearly three quarters of the $236 billion expected in revenues. Of the government market, 15 countries will possess 90 percent of the market value. Those 15 have existing space industries and are already equipped with the necessary knowledge and infrastructure. Most of the remaining 10 percent is expected to come from 30 emerging space countries and will create a market of more than $1 billion on average per year. The fastest emerging space countries, are Brazil, Argentina, South Korea, Taiwan, Malaysia and Nigeria, according to Euroconsult.

“Countries enter the space arena in two ways, either consecutively or simultaneously by ordering a GEO communications satellite for operational service from a foreign manufacturer and/or by developing indigenously a very small satellite with foreign support,” said Villain. “The second satellite in low earth orbit is generally more capable than the first one as it has an operational purpose for earth observation while the first one was rather emblematic.” In the past few years 12 government-backed operators, including Sri Lanka and the Congo, obtained their first satellite, becoming independent from third parties for satellite bandwidth.

Governments often get involved in the satellite industry to make use of telecommunications and Earth Observation (EO) equipment. These technologies can be applied to a number of agendas ranging from sustainable development to disaster prevention and damage mitigation. The variety of applications makes EO an attractive area of operation for governments. However, Euroconsult expects EO to comprise only 10 percent of the market for commercial satellites, with the demand stemming predominately from civilian government agencies.

“Governments obtain EO imagery for security and defense mainly through proprietary satellite systems. They also buy imagery from a few privately financed satellites (e.g. DG, Astrium). Several commercial constellations of small satellites for EO are planned but not yet financed,” said Villain.

Future satellites are also expected to make greater use of electric propulsion systems. Today only four out of 65 GEO satellites currently under construction are based on all electric propulsion. By 2022 Euroconsult anticipates that 25 percent of new GEO satellites will be all electric. This is contingent upon continued improvement in cost-effectiveness from more launch solutions, new thruster technology and more flight heritage.

GEO satellites will also become lighter with the growing acceptance of electric propulsion for orbit raising. This is a useful tool for avoidance maneuvers to prevent collisions and damage from orbital debris. Other satellites will be operated in LEO to avoid the debris. Euroconsult also expects future designs for both satellites and launch vehicles to incorporate plans for natural or controlled reentry procedures pursuant to Inter-Agency Space Debris Coordination Committee (IADC) guidelines.