OmniAccess CEO: Satellite Tech the Hold up for Greater Maritime Growth

[Via Satellite 11-30-2015] OmniAccess CEO Bertrand Hartman sees the need for satellite technology to increase in capability in order to keep pace with the runaway demand for connectivity on the seas. The company, which provides satellite connectivity primarily for the yachting sector, is interested in seeing developments across the industry ecosystem that will help keep pace with the demand for broadband among customers.

“The general tendency you see with the Internet is whatever the need was tomorrow it has to be double,” Hartman told Via Satellite. “We have seen an incredible growth — beyond exponential almost — in terms of the amount of throughput we are moving. There seems to be no limit at this moment. The satellite technology is actually the limiting factor.”

Hartman said there are many unique requirements to the maritime sector that make it challenging to address. Not unlike in aviation, vessel operators are vying to reach higher throughputs with small antennas, and to maintain links while in motion. Weather, coverage, and antenna failures all amplify the difficulty.

Hartman said it is possible maritime growth could be happening even faster than in aviation, which has taken the spotlight in recent years, thanks to greater agility and less regulation. OmniAccess has invested in High Throughput Satellite (HTS) technology notably through a partnership with Panasonic Avionics, which is pursuing what it calls “Extreme High Throughput,” or XTS for In-Flight Connectivity (IFC). In a previous interview with Via Satellite, David Bruner, VP of global communications at Panasonic Avionics, described the company’s XTS strategy as layering on more HTS capacity in high traffic areas on top of preexisting global coverage. OmniAccess reached global coverage three to four years ago, and is gearing up to leverage more HTS capacity for sea-faring vessels through this partnership.

“I would call it next generation HTS. It has significant amounts of bandwidth, which to a certain extent will enable us in the market we serve to have even faster links for lower cost per megabit than what we offer today. That was really the main driver. We are moving very substantial amounts of bandwidth even for a relatively small company,” he said.

Hartman added that in certain locations like the Pacific, OmniAccess simply cannot find enough capacity for its customers. Though not a huge market for the company, the supply is limited in this area, he said. This could change in the future, however.

“We see it highly likely that capacity will increase over the oceans due to increasing demand and the fact that it usually commands a premium over land coverage, Susan Bull, senior consultant at Comsys, told Via Satellite.

She said for maritime VSAT use in general, operations and crew welfare are the primary drivers. New attitudes and interest from customers have shifted vessel operators away from restricting communications to using more; a change Bull said is strengthened by improvements in stabilized antenna technology and service initiatives on the part of the operators.

Hartman said modems and antennas will need to evolve alongside the space segment. OmniAccess is working with Phasor on electronically steered antennas, which Hartman believes will find a home on many ships. In yachting and high-end markets, their appeal is not only in efficiency, but also aesthetics.

“We are interested in this for a couple of reasons,” explained Hartman. “First of all, the outstanding point would be the fact that it’s flat and that it doesn’t make your boat look ugly. That is a very serious factor. If you look at a typical large mega yacht, you can easily count six, seven or even 10 dome antennas, and these are big antennas. They destroy the design of a vessel, so from a customer perspective it leaves the design of the boat more intact … if you go a level deeper, it’s the fact that the risk of failure is a lot lower. By the fact that it is electronic and easier to operate, you remove the need for the human element as well as potential for problems.”

Particularly in the case of Phasor, Hartman said the scalability of antennas is the biggest upside. He expects electronically steered antennas will boost the capabilities of traditional satellites with wide beams, and spur the adoption of satellite services from constellations in low and medium Earth orbit.

Hartman said he is unsure how HTS will change the business model for maritime connectivity, as the technology does bring with it changes in implementation.

“It’s a bit of a confused muddle. I think satellite operators themselves are struggling with the whole concept, because HTS is more than just a handful of additional megahertz. It really begs the question from a satellite operator’s perspective: what is our market? Are we selling megabits? Are we selling Megahertz? It’s almost an implicit consequence of operating HTS networks that it makes you half a step away from getting into the vertical already,” he said.

He does expect HTS will easily become the dominant form in the yachting space. Comsys believes uptake will start off in specific regions before assimilating into the norm.

“Each segment of the market will react differently to the opportunities and challenges on HTS systems. The question is complex in the sense that coastal coverage for the overflow of consumer Ka systems will probably be rapidly taken up by smaller yachts due to much lower costs whilst global HTS systems may well be challenged by the massive areas their bandwidth coverage has to be spread over. In the longer term, we see HTS systems simply being absorbed into the capacity available to operators and the differentiation of an HTS service versus standard FSS wide beam service going away,” said Bull.

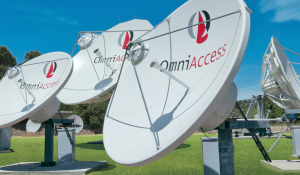

OmniAccess continues to update its infrastructure to accommodate for greater capacity demand. The company’s primary teleport in Palma de Mallorca started off as two antennas on a roof, and now has 22 antennas. For global coverage, OmniAccess has hosted teleport solutions in Australia, Germany, France and Chile, and uses eight iDirect hubs. Hartman said the company is installing a few more antennas at Palma de Mallorca to accommodate the surge in demand for capacity.