Iridium Reports Strong First Quarter, Growth in M2M and Equipment Markets

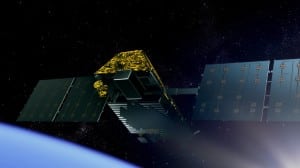

Rendering of an Iridium Next satellite. The constellation’s first launch is scheduled for June 2015. Photo: Iridium

[Via Satellite 05-02-2014] Iridium saw a significant increase in revenues in the first quarter this year compared to the same stage last year. This was one of the highlights of its latest financial results, announced on May 1. A strong performance in the lucrative Machine-to-Machine (M2M) market was one of the main reasons behind the revenue surge.

The reported first quarter revenue was $98 million, a 10 percent increase in comparison to the $89.2 million in revenue from first quarter 2013. The company gained 8,000 subscribers in the first quarter mostly due to its large spike in M2M data subscribers, which represented a 9 percent increase year-over-year.

“We affirmed our 2014 and long-range outlooks across the board today and showed growth in our key financial and operating metrics,” said Iridium CEO Matt Desch. “Total service revenue grew 7 percent with broad-based contributions from different sectors, and our equipment business is starting to rebound nicely from its decline in 2013, posting a 16 percent gain on the strength of higher overall unit sales.”

The company’s M2M data service business increased by 20 percent year-over-year, from $11.3 million in revenue in the first quarter of 2013 to $13.5 million in Q1 2014. A good portion of this “strong organic growth” can be attributed to the release earlier this year of devices such as the Iridium Burst. The company expects to see gains in the second quarter from installations beginning for its 2013 deal with Caterpillar, which it sees as another promising development in the M2M market.

While it is clear that Iridium has shown accelerated growth in M2M revenue, it also comes at a time when its competitors in the market have made determined strides in regaining their share in the voice and data sectors. Globalstar and Orbcomm, for example, are also aggressively targeting the M2M market.

“Iridium has a short window to pursue this market since Orbcomm’s next generation constellation is scheduled to launch in two batches, the first later this month,” said James McIlree, CFA, senior analyst at Chardan Capital Markets in a May 2 financial report. “After that, Orbcomm will be in a much stronger position to protect itself from Iridium’s encroachment. At the same time, Iridium needs to protect its voice market from Globalstar, which is seeking to win back customers [who] ceded to Iridium over the past five years as its constellation deteriorated.”

Globalstar also recently filed a petition to the U.S. Federal Communications Commission (FCC) to dedicate some of its now-operational second generation constellation for terrestrial use, a move that could certainly provide the company a higher cash flow to gain back traction in the voice market.

Nevertheless, Iridium is confident in its advancements in the M2M market — both in revenue from new products and added billable subscribers — and looks forward to the gains expected from the Caterpillar deal in the second quarter of 2014, as well as future similar deals.

“We are in different stages with a number of different suppliers, all the way from technical trials to commercial discussions — a lot of different levels across the board. I think that characterizes that it’s a pretty busy space for us right now,” said Desch.

Throughout the Q1 financial results call, Desch and Iridium CFO Tom Fitzpatrick increasingly hinted at discussions with “other heavy equipment manufacturers,” suggesting that there could be more deals to arise in the M2M space in addition to the 2013 agreement with Caterpillar.

In addressing the ongoing negotiations with Iridium’s credit facility, analysts believe a likely capital raise is expected in the future as the company prepares for the execution of programs such as the Iridium Next constellation.

“In short, we’ve agreed in principle to all the key terms, including the modification of certain financial covenants, and expect that the final resolution is imminent,” said Fitzpatrick. “This will give us the needed flexibility to execute our operating plan during the heart of the Iridium Next construction and launch period, while also fortifying our capital structure and funding profile.”

The Iridium Next constellation, a $3 billion dollar investment for the company, is on schedule to have its initial launch in June of 2015, and Iridium recently performed upgrades on its ground infrastructure in preparation for the project’s execution. The constellation is set for full deployment in 2017, and the first flight hardware was recently delivered to Orbital’s new satellite production facility in Arizona.