Boeing, Airbus Working to Offset the Cons of All-Electric Propulsion

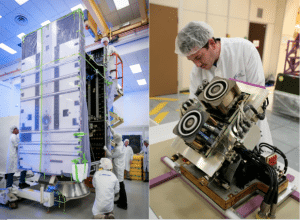

On the left, Boeing’s ABS 3A. On the right, Airbus’ current plasmic propulsion system for Eurostar 3000. Photos: Boeing and Airbus DS/Astrium SAS 2008

[Via Satellite 03-28-2014] Electric propulsion is by no means new to the satellite industry, but the last few years have seen a surge in interest as customers begin to consider and purchase all-electric satellites instead of just hybrid. Previously used only for station keeping so gravity and atmospheric drag don’t deorbit satellites prematurely, satellite operators are now using the technology to raise their spacecraft from transitional orbits to geostationary orbits as well. All-electric satellites, though they can be costlier, can weigh as little as half the amount of their chemically propelled counterparts, which is opening up new creative options for designers.

“There was a change in the market in recent years,” said Eric Béranger, head of space systems and programs at Airbus Defence and Space. “With the arrival of SpaceX, thanks to which in this category of weight … the combined cost of the satellite plus the launch service for the satellite to arrive in orbit suddenly is reduced. At the end of the day the reduction in the cost of launch is bigger than the extra cost of the electrical propulsion system.”

Airbus, with its Eurostar E3000 platform and Boeing with its 702SP platform, lead the industry in all-electric satellite design. Each is looking at different ways to further reduce the negatives associated with alternative propellant systems. The chief drawback for all-electric satellites is the time spent migrating from the launcher’s drop-off point to the final orbit — a task that only takes days with chemical propellants, but can take upwards of six to eight months with an all-electric system. Time spent in transitional orbits detracts from the amount of revenue operators can collect from their assets.

“For the operator, that can be a very high cost because they have all their money on the table,” explained Béranger. “They have paid all their capex, so the sooner they can generate revenues with their satellite in orbit, the better … [but] what matters for the operator is not so much the cost of the satellite on one side and the cost of the launcher on the other. It’s really the combination which is important.”

However, Bruce Chesley, vice president of business development at Boeing Space and Intelligence Systems, is not that concerned about the time from launch to in-orbit operation. “The time that is most important to the satellite operator is the time from contract award to the time they can operate their satellite. So with manufacturing efficiencies, we’ve driven down the manufacturing, integration and test time so that the total program time is very comparable — in the ballpark of 30 to 32 months from contract award to on orbit operations after orbit raising,” he said.

Boeing’s 702SP satellite bus uses a propellant system called the Xenon Ion Propulsion System (XIPS), which has a significantly higher efficient delta-v performance than hydrazine. XIPS has 10 times the specific impulse — think gas mileage — of traditional fuels, meaning it requires 10 times less fuel to launch and carry.

Airbus recently partnered with Snecma to integrate the company’s PPS5000 electric propulsion engine into Eurostar satellites for missions requiring positioning maneuvers. The company is working to optimize its Eurostar E3000 platform for all-electric with Snecma, as well as separately working on the European Space Agency’s (ESA’s) Neosat next generation platform for 2019.

“We are extremely happy to have chosen the Hall Effect Thruster ‘plasma’ technology,” said Béranger. “[First,] the operational feedback in orbit is extremely good, and second, this technology offers a higher level of thrust in orbit, which means you need less time to get to your geostationary orbit. Typically in some cases it can take as little as two to three months, which is a very significant advantage.”

Today, Airbus has seven hybrid satellites that use electric propulsion in orbit for station keeping, and three more being built. ABS 3A and Satmex 7, Boeing’s first two all-electric satellites, are scheduled to launch on SpaceX’s Falcon 9 in 2015. According to Chesley, Boeing is working on further streamlining the manufacturing process to shorten the production time of all-electric satellites.

“In rough numbers, we’re in the sub-27 to 29-month period,” he said. “And that’s the first time around. We have a lot of opportunities to drive that closer to 24 months, [which] is really where we are aiming … the other thing is the economics of the electric propulsion and the ability to dual launch is pretty compelling. People are willing to look at the bigger picture, and the orbit-raising time is not going to be a show-stopper because of these other advantages.”