Spacecom Seeking Placeholder Satellite While Building a new Amos 6

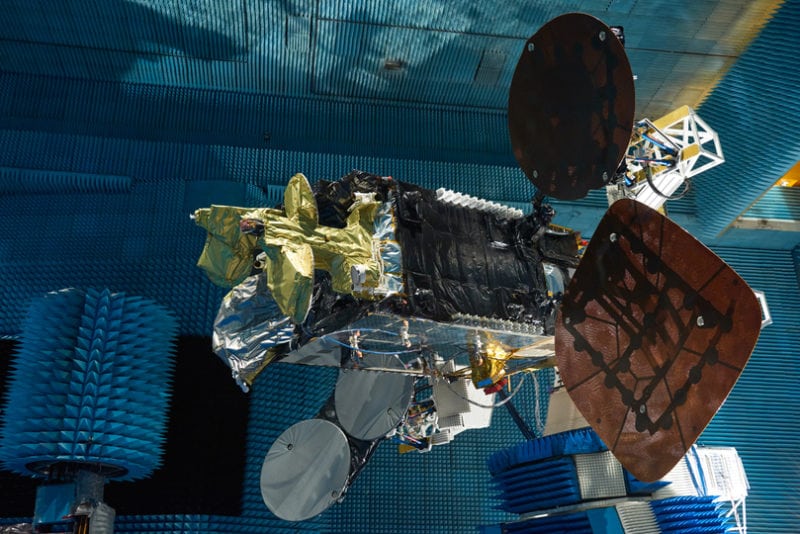

[Via Satellite 09-29-2016] In the wake of losing the long anticipated Amos 6 satellite Sept. 1 during SpaceX’s Falcon 9 rocket explosion, satellite operator Spacecom has created a plan to cover lost ground as quickly as possible. Amos 6, the most advanced communications satellite ever built in Israel, was bigger than Amos 2 and Amos 3 combined, equipped with 39 beams in Ku-band and 24 high throughput Ka-band spot beams. The satellite was to support Facebook and Eutelsat in bringing internet connectivity to Africa as well as expanding Spacecom’s presence there and into Western Europe. Furthermore, the spacecraft was to replace Amos 2, which launched in 2003.

Speaking to Via Satellite, Spacecom Co-founder Jacob Keret, SVP of sales and marketing for Europe, North Africa and the Middle East, said the company is working on two projects to fill the gap created by the loss of Amos 6. The first is a temporary fix that involves finding a satellite already in orbit that can be relocated to 4 degrees west, the current location of Amos 2 and 3, and the intended location of Amos 6.

“Our first priority is to bring an in orbit replacement satellite to 4 degrees west. That is something we are exploring right now with other satellite operators, and I expect to have a clearer view about that in the next few weeks,” Keret said.

If Spacecom can find a satellite with suitable frequencies and coverage that is already in orbit, Keret said the operator would seek to use this as an interim solution to cover the two to three years time needed to rebuild the Amos 6.

“For the longer term, we have the design of Amos 6, so this is something that can be done. It’s between two to three years to complete such a satellite. So we have a two-stage program: one is to bring a replacement satellite in orbit and the other is to build a new one and bring it later,” he said, adding that Spacecom may consider modifying the design of the Amos 6 duplicate if deemed appropriate.

Spacecom’s launch insurance did not cover the loss of Amos 6, because launch insurance is only live after the launch starts, and the Sept. 1 explosion occurred about eight minutes prior to a test firing. However, Keret said the operator will not incur a massive financial loss in this regard because of other prearranged contract details.

“We are going to get all the money that we have spent for the satellite in accordance to the contract we have with the builders of the satellite, Israel Aerospace Industries (IAI), as well as the premiums we already paid to the insurance providers. Our shareholders and bondholders actually were not affected immediately in terms of proceeds,” he explained.

Whether other facets of the Amos 6 plan can be equally reconstructed is unclear at this point. Keret said Spacecom is still in negotiations with SpaceX regarding reimbursement, and is in discussions with Facebook and Eutelsat as to whether that deal can be reconstructed. Spacecom’s acquisition by Beijing Xinwei Group of China was also contingent upon the successful launch and in-orbit checkout of Amos 6. Keret said the satellite loss did not kill the acquisition, though it had the right to.

“Discussions are going on as we speak,” he said. “The shareholders and Xinwei have to reassess the new conditions, and I would guess that they are negotiating also about the value price of the company after the loss of Amos 6. They had the right to walk away, but they didn’t do so.”

Amos 6 is the second satellite Spacecom has lost in less than a year’s time. In November 2015, Amos 5, located at 17 degrees east, suffered a power failure and ceased communicating. The magnitude of the loss of Amos 6, however, due in part to Facebook’s involvement, has highlighted Israel’s lack of a national space policy. Keret said there is a real need for a government policy in this regard.

“[It is] something that personally I think should have been done many years ago — not connected to one satellite or another, but as a general policy. Unfortunately but fortunately, the loss of Amos 6 did initiate this process and I hope something will come out of it, but no one can guarantee this,” he said.

Despite the setback, Keret said he is still confident in the market potential of the Europe, Middle East and Africa region. Customers on Amos 2 and Amos 3 have not expressed a desire to shift elsewhere, he said, and Spacecom is continuing to provide the same services in orbit as before Sept. 1. Amos 6’s capacity was mostly spoken for, with Facebook and Eutelsat purchasing the entire Ka-band payload and two thirds of the Ku-band supply already pre-sold. Keret said Spacecom ultimately remains optimistic about the future.

“We definitely see in our areas of operations and with our customers, growth perspective. Our effort to bring this replacement satellite is to generate more revenues. We have some concrete guaranteed revenues that we can do, so the future is good,” he said.