GeoOptics Talks Benefits of Commercial Weather Contract with NOAA

[Via Satellite 10-07-2016] GeoOptics, a company currently in the process of building a constellation to collect environmental data via satellite, has emerged as one of the first two companies awarded a commercial contract with the United States National Oceanic and Atmospheric Administration (NOAA), which is now purchasing satellite weather data from commercial providers.

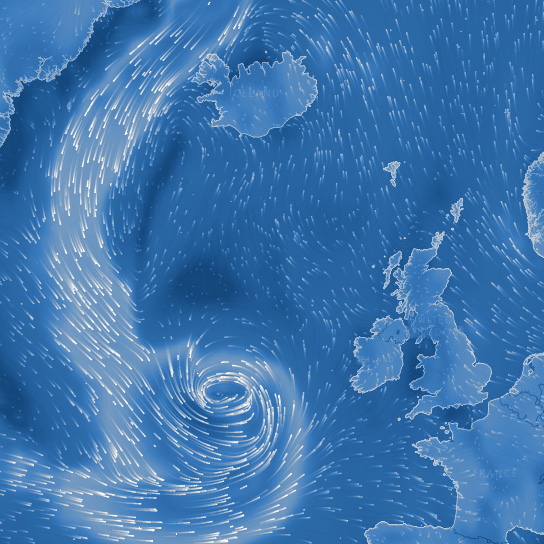

The contract, which rings in at $695,000 for GeoOptics, calls for the satellite company to provide space-based Global Navigation Satellite System (GNSS) Radio Occultation (RO) data to NOAA for the purpose of demonstrating data quality and potential value to NOAA’s weather forecasts and warnings. The satellite data provides information on atmospheric temperature, humidity and pressure, which can be used to create and prove weather forecasting models, but as GeoOptics CEO Conrad Lautenbacher points out, the contract, as of yet, is only for a test program.

“The commercial weather-data pilot program will allow NOAA to test commercially produced RO data. The testing will provide confidence that the data will be valid and useful as input to current weather computer models,” Lautenbacher told Via Satellite.

The contract, which also awarded $370,000 to Spire, is part of NOAA’s Commercial Weather Pilot Data program, which will serve to evaluate commercial data to demonstrate the quality of the data and its impact to weather forecast models, as well as informing NOAA’s process for ingesting, evaluating and using commercial data in the future. GeoOptics will obtain the data through its cubesat constellation, CICERO, scheduled to launch to Low Earth Orbit (LEO) in early 2017 and begin providing data to NOAA late in the second quarter of the year.

“We are able to obtain significantly improved vertical resolution for temperature, humidity, and pressure. RO data is currently used to provide an independent check or calibration of the bulk of the satellite data now used in HPC weather modeling,” said Lautenbacher. “RO instruments work by determining the bending of radio waves transmitted through the atmosphere by a satellite (GPS) on one side of the Earth and received by another satellite (CICERO) on the other side of the Earth.”

Essentially, the aim of the program is to provide commercial data on Earth’s climate and weather to buyers like NOAA at a lower-cost while also offering greater flexibility.

““Efficiency, low cost, ease of use, and continuity of operationally required data. It is a challenge in the federal government to obtain capitalization for new equipment. Buying the data directly is much less expensive and faster. The commercial sector provides the capitalization and takes advantage of the significant efficiencies created by companies subject to the pressures of competition and open-market forces,” said Lautenbacher.

“If you look at the cost of what we’re doing versus what NOAA pays today, it’s orders of magnitude difference,” he adds, noting that, should the test contract flourish into further contracts, the savings for the public and NOAA could be considerable enough to switch to what he calls a “mixed model.” This would involve NOAA making use of its own data as well as data from a commercial contractor in order to inform weather forecasting.

NOAA seems to agree, calling the approach a “win-win solution” in a statement announcing the contracts, as both NOAA and the commercial firms will gain a trial run of the NOAA evaluation process, a necessary first step to considering sustained operational use of new commercial weather data.

“NOAA could still build satellites, but for certain classes of data it makes economic and operational sense to buy data directly via commercial contract,” he adds.

The contract with NOAA has helped GeoOptics considerably when it comes to raising funding to build and launch its constellation, which Lautenbacher says is still in progress. While declining to reveal the amount GeoOptics has raised thus far, he said there were considerable difficulties around raising capital up to this point as many investors didn’t quite understand the company’s mission to provide detailed satellite data on the Earth’s atmosphere, surface and subsurface.

“Raising money was initially a challenge because of the lack of an established market for commercially produced weather data,” said Lautenbacher.

But as interest in small satellites grows and viable cubesat constellations enter into orbit, the company has seen a pique in interest from investors.

“We’ve been able to raise what we need — enough to be quite viable at this point. As we’ve made progress, so have others. It has become easier to raise money, one reason being there are other types of cubesats in orbit today producing useful data,” Lautenbacher added.

Going forward, in the near term, the company will continue to focus on raising the necessary funds to launch its constellation as well as expand the market for radio occultation in the commercial and government sectors. Beyond that, the company is also looking to expand into new weather technologies.

“Our long-range business plan goes well beyond radio occultation and includes significant expansion into other technologies that can be miniaturized and harnessed to provide a full range of environmentally significant observations,” said Lautenbacher.