Terran Orbital, Lockheed Martin Hope to Crack Government Market

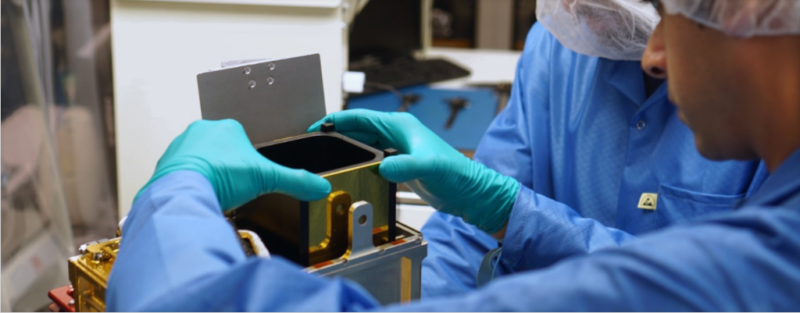

Terran Orbital engineer constructs a satellite platform. Photo: Tyvak.

Lockheed Martin Ventures has made a strategic investment in Terran Orbital, a company that specializes in nanosatellite design and manufacturing, as well as mission operations. According to Chris Moran, executive director and general manager of Lockheed Martin Ventures, the partnership will allow Lockheed Martin to pursue more advanced nanosatellite solutions, particularly for customers in the U.S. government.

“These guys [Terran Orbital] are building their processes and capabilities to deliver smallspace operations at a low cost,” Moran told Via Satellite. “That allows us to go after a broader variety of programs by teaming with them than nominally we can do on our own.”

Lockheed Martin Ventures has been investing in small businesses since 2007, but recently pivoted to focus purely on early-stage companies that are complementary to Lockheed Martin’s own technology and services. “The vehicle for doing that is small equity investments from $1 million to $5 million dollars in any company. Then we manage those to hopefully a successful exit,” Moran said.

In total, the company has carved about $100 million out of its balance sheet for the venture fund, which so far has had a successful track record in terms of the return on its investments. “We’ve had at least one IPO, a couple acquisitions and one failure, which is pretty typical at a venture fund. But on a cash-return basis, it’s been doing pretty well,” Moran said, adding that the fund is performing in the upper third of returns.

Terran Orbital also hopes to leverage this partnership to expand its government services under its Tyvak brand, according to the company’s CEO Anthony Previte. Currently, the majority of Terran Orbital’s customers operate in the defense and intelligence spheres — although the company has also seen an uptick in orders from the financial sector and for scientific research.

“Most of our customers aren’t space people. That’s not their focus. They’re focused on other existing legacy businesses … [and] they’re looking for some asymmetrical advantage over a competitor,” Previte told Via Satellite. Under its Tyvak brand, the company has coordinated a range of missions as varied as high-speed radios to high-resolution Synthetic Aperture Radar (SAR) payloads.

Terran Orbital specializes in creating custom satellite buses unique to their respective missions, Previte said. Out of the 80 or so programs the company has completed, only a small handful have comprised more than one satellite. “Rather than have some predetermined bus define the mission, the mission defines the spacecraft, which is the way it should be,” Previte said. “It’s a limited form factor and mass, so the best way to optimize that is by optimizing your spacecraft for the mission.”

“The trend for us is definitely going toward harder, more challenging missions — the edge of what physics permits,” he added. For example, one of Terran Orbital’s pharmaceutical customers was looking to test a centrifuge in orbit to synthesize proteins, which is a notable engineering challenge due to the way a centrifuge spins. “We ran that cradle to grave,” Previte said. “We designed the centrifuge, we built the spacecraft, [and] we launched it on orbit. We run the entire gamut so people can come to us as a one-stop shop.”

Previte believes the opportunity in nanosatellites is so significant that “it was beyond our ability to fund,” he said. Thus far, the company has organically achieved double-digit revenue growth rates every year, but according to Previte, its backlog has expanded so quickly that it can’t afford the facilities and infrastructure to keep up with demand. As such, Terran Orbital will use the investment from Lockheed Martin Ventures to build out a new 37,000-sq. foot manufacturing facility.

Previte described the new capital as “incredibly enabling” for the company’s long-term goals, including reaching the $100 million revenue mark, and said the tremendous overlap between Lockheed Martin’s services and its own will result in a long and synergistic relationship between the two companies.

“This investment has been really material to this business,” he said. “We have access to work on the government side that we never would have been able to go after.”