VSAT technology is a major deal for the maritime industry. In a very short period of time, VSAT networks have pushed the maritime industry toward significant business modernization. Now with adoption moving full steam ahead, a new wave of technology and service innovation is set to make VSAT more affordable and easier to install, while delivering greater business value.

VSAT technology leader VT iDirect and nine of its maritime partners examine the opportunities ahead for one of the satellite industry’s most vibrant markets.

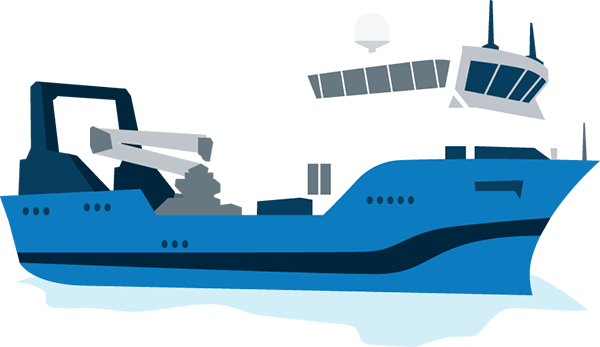

Not long ago, when a vessel would disembark from port, it would also unplug from the global communications network. Today, an increasing number stay connected with VSAT – providing their crew and passengers with high-speed Internet access and phone service, monitoring weather patterns to cut fuel costs, filing regulatory documents and ordering supplies from sea to save time in port and generating business intelligence through a growing range of software applications.

According to the newly published fourth edition of The comsys Maritime VSAT Report, more than 20,000 vessels are currently online. The addressable market that once stood around 10,000 vessels has surged to more than 51,000, which represents 71% of the total market and equates to significant growth ahead.

Recent market growth has been very healthy, despite the global economic downturn. Between 2012 and 2013, VSAT installations increased by 25%, while service revenues grew by 15%, now totaling $1.3 billion.

Comsys projects significant market growth in vessel adoption. By 2018, there will most likely be 44,242 vessels with VSAT, more than double comsys’ last recorded number in 2013. The largest segments will be commercial freight at 21,595 vessels, followed by yachts at 6,973 and fishing trawlers at 5,660.